Monetary Policy Committee of the Bank of Ghana has reduced its policy rate by 100 basis points

Monetary Policy Committee of the Bank of Ghana has reduced its policy rate by 100 basis points

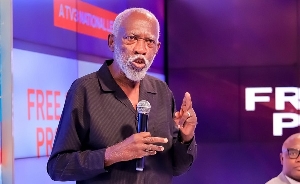

The Monetary Policy Committee of the Bank of Ghana has reduced its policy rate by 100 basis points to 22.5 percent, in what was the first MPC meeting chaired by the new Bank of Ghana (BoG) governor, Dr. Ernest Addison.

The Monetary Policy Rate (MPR) is a monetary policy tool of the BoG and it is the rate at which commercial banks can borrow from the central bank.

It communicates the monetary policy stance of government, influence money supply and also guide market interest rates.

Dr. Addison, speaking at a news conference in Accra, said that although inflation rose marginally in April to 13 percent from 12.8 percent in March, inflation expectations have broadly trended downwards.

According to him, the process to fetter inflation was supported by the bank’s tight monetary stance as well as stability in the exchange rate regime.

The bank insists that its forecast horizon for inflation remains unchanged and inflation is expected to trend downwards the medium target of 8±2 next year.

“With a stable outlook for exchange rate movements and return to the path of fiscal consolidation, headline inflation is expected to trend towards the medium-term term target in 2018, barring any unanticipated shocks.

The 2017 budget, according to Dr. Addison, indicates a return to the path of fiscal consolidation. With government forecasting a reduction in budget deficit from about 9 percent to about 6 percent, the governor argued that such reduction is expected to foster more stable macro-economic condition, adding that that rigorous implementation of the budget will therefore be critical to the outlook.

Given these considerations, the Committee judged that the downside risks to growth outweigh the upside risks to inflation in the outlook, and therefore decided to reduce the policy rate by 00 basis points,” he explained.

Outlook, risks, debt and more

The Monetary Policy Committee (MPC) noted that the pace of economic activity has picked up, driven mainly by growth in private sector credit, improved business sentiments and easing credit stance.

Furthermore, increased oil production from both Jubilee and TEN fields and the coming on stream of further activity in the oil and gas sector from the Sankofa GyenyameNtomme (SGN) fields by the third quarter should give added impetus to overall growth prospects.

According to the bank, there is evidence to suggest that the economic imbalances that existed at the end of 2016 are giving way to stronger fundamentals with economic activity expected to pick up strongly in the period ahead, albeit below potential.

The bank also noted that developments in the external sector point to significant recovery in exports over the first four months of 2017, on the back of increased production volumes and prices of gold and crude oil.

This, together with lower imports, resulted in a trade surplus estimated at 2.5 percent of GDP, compared to a deficit of 2.2 percent recorded in same period of last year.

Also, the volatility in the foreign exchange market observed at the last MPC meeting has eased significantly, supported by improved foreign exchange liquidity conditions and the outturn in the trade balance, with a more positive outlook based on significant expected inflows.

Cumulatively, the local currency has depreciated by 1 percent against the US dollar as at May 18, 2017.

The stock of domestic debt which was GH¢53.4 billion, 31.9% of GDP, at the end of 2016 increased to GH¢55.2 billion, 27.2% of GDP, at the end of March 2017. The external debt also increased from GH¢69.2 billion, 41.3% of GDP, at the end of December 2016 to GH¢71.9 billion, 35.3% of GDP.

This brings the total public debt at the end of March 2017 to GH¢127.1 billion, 62.5% of GDP, up from GH¢122.6 billion, 73.3% of GDP, at end 2016.