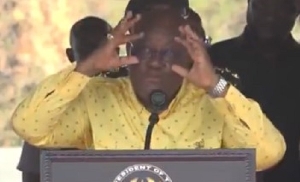

Vice President, Dr Mahamudu Bawumia at the launch of the Mobile Money Interoperability

Vice President, Dr Mahamudu Bawumia at the launch of the Mobile Money Interoperability

CEO of SIBTON SWITCH, Denzel Lawson, has described as “rubbish”, assertions by Vice-President Dr Mahamudu Bawumia and the Akufo-Addo government that they saved Ghana over GHS4 billion ($1.1 billion) by cancelling an earlier Mobile Money Interoperability contract with the SIBTON and re-awarding it to the Ghana Interbank Payment and Settlement Systems (GhIPSS) at a cost of $4.5million.

Dr Bawumia recently launched the interoperability system in Accra.

Interoperability enables customers to undertake money transfers between two accounts at different mobile money companies or to transfer money between mobile money accounts and bank accounts.

In October 2017, Dr Bawumia said: “There were many people who were offering similar solutions, but thankfully the BoG, in collaboration with GhIPSS, has finally been able to solve this problem...”

“What is even more remarkable about what has happened is that, again, a lot of people were quoting billions of dollars and it became an issue of public debate, but by the way, this system has now been built for less than $4 million dollars,” he said at the University of Cape Coast when he spoke at the school’s Institutional Advancement Lecture last year.

Also at a press conference on Tuesday, 15 May 2018, Deputy Information Minister, Kojo Oppong Nkrumah, said the Akufo-Addo government saved the country from “unjustified extortion” by the erstwhile Mahama administration by re-awarding the contract to GhIPSS.

“The Akufo-Addo administration at this stage is pleased to have had the opportunity to engage all the stakeholders to correct what would have been an unjustified extortion from the good people of Ghana if the old deal had not being abrogated,” Mr Oppong Nkrumah, said.

According to him, per the earlier agreement, the Bank of Ghana (BoG) agreed that SIBTON charges “the users of the platform, and who are the users of this platform predominantly? These are market women, farmers, drivers; people in the lower class are those who massively use these platforms that have been rolled out. Their arrangement was that the company SIBTON should charge these people $1.2bn; that is essentially what they did”.

The Akufo-Addo Government, he noted, engaged relevant stakeholders to ensure that the system was implemented under a new cost-saving structure.

“Government, through the Bank of Ghana, through GhIPPS, is paying $4.5m and the Ghanaian at the end… who normally use this platform, does not need to pay a private company $1.2bn for their profit. This is a big savings to the people of Ghana”.

For him, “The arrangement [by the previous government] begs the question why GhIPPS was not even invited in the first place to do the job. Remember GhIPPS was set up to develop an interbank payment platform here in Ghana, so, if you are moving a step further to add interoperability platform, it only makes sense that GhIPPS be requested or charged to do the job and that is what we have done currently. It will make some people ask if somebody was creating a convenient scheme for persons to benefit”.

He dispelled suggestions that the initial deal was the best, adding that: “There is no EOCO report that claims that the SIBTON deal is the best deal”.

Responding to these assertions by the Vice-President and the Government, Mr Lawson told Francis Abban on Accra-based Starr FM’s Morning Show on Wednesday, 16 May that: “I know that the Vice-President has quoted on several occasions that he saved the country GHS4billion or something from rescuing it from the SIBTON contract.

“The simple fact is that under the SIBTON contract, there was no expenditure by the Ghana Government or country or anybody. It was a Build and Operate model, OK. In other words, we were making all of the investments, putting all the infrastructure in place in return for a fee revenue over a period of time, which as I said was much cheaper than this now being charged by the Bank of Ghana.

“Now I understand that to put in place the Bank of Ghana infrastructure in GhIPPS, they’ve actually have to spend four or five million dollars to do that, so, actually the country is four or five million dollars worse off than it was before, by scrapping the deal it had with SIBTON SWITCH, so, you know, it’s rubbish”, he said.

Asked by Francis: “What is rubbish?”, Mr Lawson, who spoke on the phone from Asutralia, said: “Rubbish is the fact that people are saying that they’ve saved the country billions of dollars by doing it with the Bank of Ghana, it’s rubbish, the simple fact is the SIBTON contract had no cost at all to Ghana, the Bank of Ghana solution has cost the country, so far, four or five million dollars”.

According to him, SIBTON’s “fees and charges were much less than those being charged by the Bank of Ghana”.

“We were going to provide the infrastructure for zero and we were going to provide interoperability, which was agreed between the Bank of Ghana and the telcos at 1.5 per cent, which is less than the two-and-a half per cent that interoperability provides today, costs today.

"The other aspect is that our interoperability is straight through processing, all the security is done online, no problems”.

As far as the SIBTON CEO is concerned, the technology used by GhIPPS is old fashioned. “… It’s old technology, not a classically secure way of doing payments, but anyway…”

According to him, “The system is potentially not scalable”, explaining that: “If you go around the world and look at the big switches in the world that are processing hundreds of thousands and millions of transactions, there is a handful of switches that can do that. We happened to have one of the very few switches that can process that sort of volume. Now if you believe that a switching company from Morocco is what you want to have as a national switch, then good luck to you”.