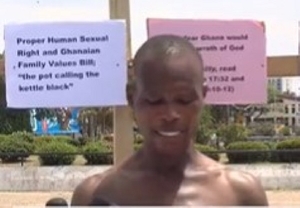

Geoffrey Ocansey is the Executive Director of Revenue Generation Africa

Geoffrey Ocansey is the Executive Director of Revenue Generation Africa

With indications from the latest Afrobarometer survey showing that 70% Ghanaians are skeptical about how government uses revenues they accrue from taxes, a tax analyst, Geoffrey Ocansey has called for stricter sanctions on businesses and persons who contribute to tax evasions.

According to the Afrobarometer survey, 84% of the 2,400 adults who were sampled, believe that some tax officials are corrupt, reports citinewsroom.com.

Geoffrey Ocansey, who is also the Executive Director of Revenue Generation Africa and member of the Tax Justice Coalition, said that stricter commitment to protect taxpayer monies will encourage more Ghanaians fulfill their tax obligations too.

“When you look at financial irregularities in 2018 alone, it was GHS5.1 billion and in 2019 the report suggests that we have lost another GHS 3 billion to financial irregularities. So, if people are seeing these reports, complicated by the things they see around them and tax officials are not able to account for their tax collections, then I am sure people will lose some trust in the tax system. There is no sacking, there is no jailing and punishment. Once the punitive measures are low, there will always be motivated offenders,” he explained.

The Afrobarometer survey, which comes on the back of the newly introduced taxes by the government, also showed that eight out of ten citizens, representing 79% said tax authorities have the right to collect taxes.

In part, the study indicated, “The analysis finds that citizens are more supportive of taxation if they believe the government is doing a good job of delivering basic services. But many citizens also express mistrust of tax authorities and see widespread corruption among tax officials.”

In its 2021 budget statement, the government introduced new taxes, including a 1% COVID-19 levy, 1% increase in National Health Insurance Levy, and 1% increase in flat VAT rate, as well as a 30 pesewa increase in fuel prices to take care of excess power capacity charges [20 pesewas] and Sanitation and Pollution Levy [10%].