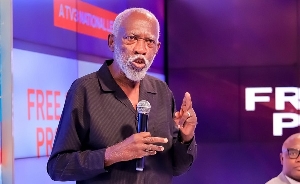

Governor of the Bank of Ghana, Dr. Ernest Addison

Governor of the Bank of Ghana, Dr. Ernest Addison

Following the banking crisis that hit the nation about two years, the regulator of banks in the country, the Bank of Ghana instituted measures to strengthen corporate governance in the banking sector.

Thankfully, such measures are paying off as Governor of the Bank of Ghana (BOG), Dr. Ernest Addison has indicated. The directives among others, set term limits on board membership, CEO’s tenure, and obliges board members to undergo training. The Governor noted that the directives have so far strengthened the operations of banks and has significantly enhanced the soundness of the banking system.

Speaking at the official launch of Absa Bank Ghana Limited in Accra yesterday, the Governor stated that enforcement of the Corporate Governance Directives have led to several board chairs and CEOs of banks ending their tenure, while board members who served for prolonged periods have been replaced.

Results of a recent survey, showed, indicate full compliance with requirements of the Corporate Governance Directives on the size, structure, composition and qualification of the bank boards; due diligence in the appointment of key management personnel; and separation of CEOs and Board Chairs.

A total of 184 bank directors undertook the mandatory annual Director’s Governance Certification training programme. Of this number, over 50 percent have fully completed the programme, while the rest who are at various certification stages will be certified by the deadline of end-March 2020.

This proves that when the regulator of any industry rests on its oars, and leaves matters to chance, all manner of breaches are likely to occur and this financial breaches took place in the banking sectors leafing to the eventual liquidation of some banks, particularly the indigenous ones.

The banking crisis was a bitter lesson for the economy since hundreds, if not thousands, of Ghanaians were affected and some still feeling the pinch of the clean-up. We are glad to hear that things are picking up since the BoG is insistent on the directives it issued in the wake of the crisis to strengthen good corporate governance. We expect them to keep up the momentum and not renege on its regulatory functions.