Ghanaian economic experts, have encouraged policy makers to introduce a harmonized exchange rate especially for operators in the port and maritime industry at fixed time intervals in order to accommodate traders and alleviate the difficulties citizens face as a result the rapid depreciation of the cedi.

“At the ports, you’ll have to fix the rate for a month and review it over time. Because currently the agents quote different prices and that brings uncertainty and anxiety within the system. Government should set a rate that would require all institutions to apply. There should be benchmark ways of harmonizing this like we have in other countries,” Prof. Peter Quartey, Director of the Institute of Statistical Social and Economic Research, (ISSER), University of Ghana said.

Speaking on Eye on Port’s live interactive platform as a co-panellist on the topic: Hunting Solutions to the Cedi Depreciation: Role of the Ports and International trade, Franklin Cudjoe, President and CEO of Imani Africa, corroborated Prof. Quartey’s assertion, suggesting a monthly fixed rate of the exchange rate in order to achieve more desirable results.

“The volatility of the cedi is real and the factors that affect it are difficult to control locally. But if the fixing could be done and allow a margin that would compensate an anticipated fall within the month, then maybe yes.”

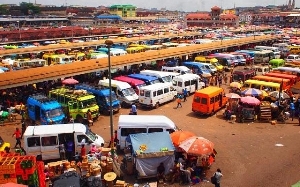

Duty payments

Sharing his opinion on the pegging of duty payments to the dollar rate which is believed to be changed every Tuesday, a Former Commissioner of Customs, Wallace Akondor said the instability of the duty rates, creates tension among importers, contributing negatively to the ease of doing business.

“Let’s consider the cycle of transaction from the time the businessman orders his goods, which is normally a period of about 30-60-90 days. If at the time I initiate the business the rate is at 5 cedis to the dollar, by the time the cycle is complete, the rate would escalate to for example 5.5, that’s a lot of money. It does not reflect the actual transaction for the business,” he cited. He further suggested, that a longer duration be considered for the rates applied on duty payments.

“Rather than having these weekly varying transactions at the port, Government, would have to look at a longer duration.”

Shipping charges

A Deputy Minister of Trade and Industry, Carlos Ahenkorah, who also participated in the panel discussion, decried certain components of shipping charges in the country describing them as unjustifiable. According to him, such huge payments which account for almost 700 million dollars annually are repatriated to foreign countries, therefore, contributing significantly to the fall in the cedi’s value.

“It is important for us to note that a large chunk of forex leave our shores in the name of freight. I have fought this fight for the past 20-25 years trying to explain to government that we are losing money in a certain way which is affecting us as far as our forex is concerned. It might interest you to know that on an average, every year close to 500 Million dollars is collected in this department alone. Aside that, they charge about 143 Million dollars a year in demurrage on goods in the country,” he revealed.

He urged government to fight the continuation of these charges as it is a sure way to help salvage the loss of the cedi’s value.

“As I speak to you, I have a report and I’m going to present it to the committee. We have to take this up. Let’s tackle the exit points of the country and see how it can help us. I want the bank of Ghana to go back 10years, and see how much money has been transferred out of our shores in the name of freight and they would realise how much this is affecting the cedi depreciating. It is important to assess whether this is real freight or some profit of some sort which somebody is repatriating as freight,” he charged.

Regulate Black Market

The panellists who listed the insatiable demand for imports, low value added production for exports, as some of the contributing factors leading to the fall of the cedi, also highlighted that the non-regulation of operations within the black market as another significant cause to the rapid depreciation faced.

Prof. Peter Quartey, Director of ISSER, University of Ghana, called for regulation of operators in the black market so that their activities are properly monitored.

“Once you absorb them and register them, you are able to track their operations and their activities become formal.”

Traders travel with cash

Another scenario that was cited is the common case of Ghanaian traders hoarding a lot of foreign currency in which they use to engage in their business transactions overseas depriving the country of deriving the needed forex.

Franklin Cudjoe, proposed for improved payment settlement systems with the international market, to alleviate this problem of unnoticed forex exiting the country’s borders.

1D1F to focus on rice production?

Franklin Cudjoe also suggested that, Ghana should develop a national policy that would fully harness its natural resources as an effort to cut down the deficit suffered to imports.

He opined that if the 1D1F project for instance focuses on rice production in its full extent, a lot of money would be saved domestically, where hitherto would have been lost to the international market, leading to a devaluing of the cedi.

“Government policy itself could have a direct impact on the way our currency works. The Government wanted to reduce the import bill on rice for instance which I’m told is about a billion. I would wish that the Government policy of 1 district 1 factory, should be focused on ensuring that a lot of our rice is processed, and the market is guaranteed,” he expressed.

- What exactly is your grand plan? - Franklin Cudjoe asks Akufo-Addo over sacking of SSNIT, GRA bosses

- Ghana is doing well, don't negate what we have achieved because NPP is in office – Nana Ofori-Atta

- Meet the 8 'prominent' lawyers Akufo-Addo has penciled to be justices of the Court of Appeal

- 58% of voters in the Ashanti Region say Ghana is heading in the wrong direction – Poll

- Under Mahama a whole gallon of petrol was GH¢14, today just a litre is over GH¢14 - Edudzi Tamakloe

- Read all related articles