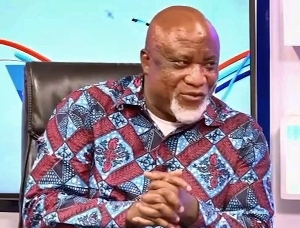

Governor of the Bank of Ghana, Dr Ernest Addison

Governor of the Bank of Ghana, Dr Ernest Addison

The Bank of Ghana has taken exception to an interview granted by a former Deputy Governor, Dr Johnson Asiama, on the recent revocation of licenses of 23 savings and loans companies.

In the said interview on Accra-based Joy FM, Dr Asiama is said to have questioned the decision to hand over the assets and liabilities of two indigenous banks – UT Bank and Capital Bank – to GCB Bank in 2017, describing the approach as cause of the crisis in the savings and loans and microfinance sectors.

“The claim that the approach to resolving the two banks resulted in the distress of the savings and loans and microfinance sectors is pathetic, to say the least,” the Bank replied in a statement issued on Friday.

“With full knowledge that these two banks were connected to other sectors of the financial system, Dr. Asiama and his colleagues were under a duty to take measures they were empowered to take under the law to avert the risks that these two institutions created for the rest of the system.”

But Dr Asiama came back again in a statement, saying his interview was without malice.

“Finally, I explained that we had a strategy for the recapitalization of banks in general and the fact that we were implementing the ICAAP framework to support this across the banking sector. These are facts, and nothing to offend anyone but if it does, then my apologies.

“I want to state that my intention was not to spite anyone or the current management of the Bank of Ghana, but to correct some of the misconceptions in the discourse regarding the reforms. I must affirm that whatever decision was taken was based on the evidence available at the time, and with a clear exit strategy in mind.”

Find below Dr Asiama’s statement:

RE: RESPONSE TO FORMER DEPUTY GOVERNOR DR. JOHNSON P. ASIAMA’S INTERVIEW ON JOY FM

In response to the Press Release from the Bank of Ghana regarding the interview I granted to Joy FM a couple of days ago, I wish to state the following:

1. The interview was meant for me to throw light on the circumstances and the reasons for some of the issues arising in relation to the banking sector reforms.

2. I took the time to explain the genesis of the problem and also to let the public know that although I was not the Governor at the time, in my view there were well-intentioned reasons why some of the collapsed banks were issued licenses at all. Key among these was the thinking at the time to encourage indigenous local banks to also feature in the banking landscape.

3. I went on to explain the macroeconomic challenges that impacted the banking industry as a whole, and the effort in introducing ESLA to help prevent a slide into insolvency by many of the banks.

4. I went ahead to explain that a lot of engagements were done with the eight (8) banks that were identified in the AQR exercise (you can check this with the head of banking supervision at the time), and different scenarios were developed and discussed with the Board of these banks. Therefore it is not true that we did nothing.

5. I also explained that there was a roadmap (or strategy) for the recapitalization banks and withdrawal of liquidity and hence these should have been followed. I suggested for example that if Unibank’s claims on government was paid early in 2017, we could have prevented the daily clearing failures that persisted and worsened the early redemptions and withdrawal of deposits.

6. It is a fact that I drew the Governor’s attention on this and we indeed had a meeting with the Minister on the particular issue somewhere in May\June 2017. Unfortunately, our view was not taken and hence the daily clearing failures continued, leading to additional liquidity support.

7. I added that if after that the ESLA plc bond had been supported by a government guarantee, all the GHS10 billion exposures to the banks would have been secured to prevent the slide into insolvency. I also added that if an additional special levy was introduced in early 2017 to pay off contractors, this also would 2 have supported the latter and prevent the slide into insolvency in some of the cases.

8. I mentioned in the interview that if the extent of interconnectedness was taken into account from the beginning of the exercise, systemically important banks such as Unibank would have been handled differently through any of the ways mentioned above. That was where I gave the example that at best we would have engaged Republic Financial Holdings on the troubled banks because I remember they wanted to purchase up to five (5) banks. Remember this would have been done much earlier and not in 2018 or beyond when the gap between the value of net assets and the deposit liabilities had deteriorated further.

9. Finally, I explained that we had a strategy for the recapitalization of banks in general and the fact that we were implementing the ICAAP framework to support this across the banking sector. These are facts, and nothing to offend anyone but if it does, then my apologies.

10. I want to state that my intention was not to spite anyone or the current management of the Bank of Ghana, but to correct some of the misconceptions in the discourse regarding the reforms. I must affirm that whatever decision was taken was based on the evidence available at the time, and with a clear exit strategy in mind.

11. It is true that I was Deputy Governor at the time when the decision was taken to revoke the licenses of UT Bank and Capital Bank, but I would not want to go into further details about those my terminal days in office.

12. I spoke as a Ghanaian and as a former staff of Bank of Ghana, just as some other former staff or Deputy Governors have done in the recent past.

End

August 23, 2019

- Financial sector clean-up: 900 people dead, pay us by June 30 - GCFM customers to government

- Bank of Ghana governor denies calling NDC MPs hooligans

- Ghana to become top destination for fintech investments – BoG

- Here is why BoG suspended forex trading licences of GT Bank, FBN Bank

- Bank of Ghana, Development Bank Ghana to launch 3i Africa Summit in Accra

- Read all related articles