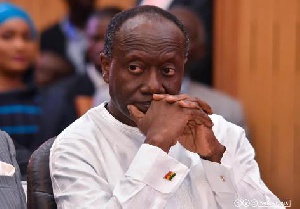

Finance Minister Ken Ofori-Atta

Finance Minister Ken Ofori-Atta

The Herald has chanced upon reports, suggesting the Bank of Ghana (BoG) could be blowing some outrageous amounts of money on the appointment of PricewaterhouseCoopers Limited (“PwC”) and KPMG, as receivers for the purpose of winding down the affairs of the collapsed commercial banks, Savings and Loans and Finance Houses.

Insiders have hinted about the procurement irregularities in the selection of the receiver, saying they were handpicked, instead of a competitive bidding process which would have ensured that the country, got value for money.

One of the receivers, Eric Nana Nipah, who is a Director of PricewaterhouseCoopers (Ghana) Limited (“PwC”), has confirmed that the company was actually handpicked to do the work it is doing with the banks, chasing properties of directors, defaulters, as well as collecting money from BoG to pay customers.

The cost of their engagements which include the management of the Ghana Consolidated Bank (CBG) as consultants, is not known to the taxpayer, but only officials of BoG, Ministry of Finance and directors of the companies.

Indeed, KPMG and PwC, have been accused of working for the BoG and the government through Finance Ministry raising doubts about the fairness and professionalism of their work.

The financial institutions, including the Kwesi Nduom’s GN Savings and Loan, Dr. Kwabena Duffour’s Unibank and Unicredit, Dr. Kofi Amoah’s Global Access, First Ghana Savings and Loans Limited, Heritage Bank and several others, have in recent times questioned the processes towards liquidation of their companies.

Some of the owners of the financial institutions, including Kofi Amoabeng – owner of UT Bank and the owner of Capital Bank; William Ato Essien, have directly accused the receivers working more for the BoG, and not ready to listen to any contrary opinion.

Several videos in circulation have shown Kofi Amoabeng, expressing shock at what the Governor of the BoG, who he knew as a man of high morals and integrity, had become since assuming his current position.

Mr Amoabeng, also took issues with Finance Minister, Ken Ofori-Atta, whom he described as a longtime friend, but had failed to inform him on the liquidation of the UT Bank, although days before then, he had had conversations with him via phone. He expressed misgivings about the seeming betrayal by his friend.

He revealed had he heard, the bank, which he admitted had some challenges, was going to be liquidated, he could have injected capital, because some investors were ready to invest in the bank.

On his part, Capital Bank CEO; William Ato Essien, also took issues with the same Finance Minister for the takeover of his bank, saying just like Kofi Amoabeng, he was making frantic effort to pump more money into the bank.

He discounted the poor description given his bank and disclosed in an interview on Metro TV’s Good Evening Ghana, Finance Minister and his partner Keli Gadzekpo, wanted to purchase Capital Bank in 2016, but he turned them down.

He questioned the desire of Mr Ofori-Atta and Mr Gadzekpo in wanting to buy Capital Bank, if it was indeed, non-performing.

Both Kofi Amoabeng and Ato Essien insisted there was no fair hearing in the whole process towards the liquidation of their companies.

Meanwhile, the lack of fairness in the process, The Herald is informed, recently, caused one of the receiving companies; KPMG to terminate the contract one of its top executives.

Reports from the industry said, KPGM’s owners outside Ghana, have carried out a review and discovered that some anomalies had taken place, and is likely to lead to legal actions against the company.

The said officer, according to The Herald’s insiders got his three-year contract extension terminated.

He had attained the retirement age of 60, but got a 3-year extension, however, the contract was abrogated upon detection that he had taken a certain decision against, one of the financial institutions, which is lacing its boots to drag the company to court.

On the procurement issues, Eric Nana Nipa, But speaking on Asempa FM recently, admitted his company; PwC, did not go through any competitive bidding process, but were handpicked by the BoG.

He disclosed that, they had heard about the impending contract from the BoG and put in a proposal, and were awarded the contract to be receivers based on their track record.

Nana Nipa, boasted about being the company that acted as receivers for the asserts of the defunct Ghana Airways Company Limited, as well as Bank for Housing and Construction, which used to be managed by now Senior Minister, Yaw Osarfo Marfo.

Interestingly, CGB is struggling to find money to settle clients of the bank which was formed from the merger of Capital Bank, UT Bank, as the government has not released the amount needed to settle the clients.

There is a flat rate of GH10, 000 being paid to the clients. Although the government has claimed it has released some billions of Ghana cedis to settle the clients.

Last month, Staff of defunct First Ghana Savings and Loans Limited, gave the BoG up to September 11, 2019, to rescind its decision to revoke their license.

First Ghana Savings and Loans Limited, which started as First Ghana Building Society (FGBS) in 1956 was originally licensed to operate as a mortgage financing institution.

From March 8, 2015, to August 16, 2019, the company served as the only savings and loans company in Ghana with over 50 percent of its customers being pensioners on the payrolls of SSNIT and the Controller and Accountant Generals Department.

Among the reasons the BoG, gave for revoking the license of the institution, were the fact that they had a negative net worth of GHC 14.08 Million and a capital adequacy ratio of negative 54.47 percent as at May 2019.

But in an address to the media on the reasons for the revocation, the convener of the Professional and Managerial Union of First Ghana Savings and Loans, Robert Agbodza, blamed the government through the majority shareholder National Investment Bank (NIB), for its woes.

“Our information was that a minimum additional capital of GH¢20 million would have averted this action. However, the government, through NIB, has watched on for the BOG to revoke our license. It is therefore preposterous for the majority shareholder (the state) of 98% who failed to discharge their responsibility of recapitalizing FGSL to turn around, using another agency of the state to accuse FGSL of insolvency and revoke its license.”

On the matter of the negative net worth and capital adequacy ratio, the disgruntled staff mentioned that the Bank of Ghana’s report failed to mention that the negative net worth and the negative CAR were arrived at after First Ghana Savings and Loans Ltd had impaired a total investment of GH¢17.5 million (GH¢19.8 million in June 2019) in uniSecurities Ghana Ltd, Gold Coast Fund Management Ltd and FirstBanC. As at June 2019, the prior impairment net worth of FGSL was GH¢5 million, whilst the CAR stood at 15.2% (all positive according to the workers).

Mr Agbodza, further went on to call on the president to as a matter of urgency to intervene to have the revocation of their license reversed.

“We are appealing to the Bank of Ghana to rescind its decision as early as practicable. There are other banks and savings and loans companies whose positions are worse than FGSL’s, yet their licenses have not been revoked. We appeal to the President to, as a matter of urgency, intervene in our case. The government would not be fair to us if it allows the BOG’s decision to stand. Finally, we demand that NIB takes its handoff First Ghana Savings and Loans to allow interested investors to take over the company.”

Even as the receiver for the 23 collapsed Savings and Loans Companies and Finance Houses continues to validate claims and make payments, some customers, some of whom were seen at the head office, called for a speedy resolution to allow them to have access to their funds. Rose Larko Otoo, is a pensioner who has been saving with the institution for about three decade.

“The current situation has really worried me because I don’t have any money. I live at James Town, and commuting to and from my place would cost me GHC 20. Someone gave me GHC 10 to pick a car here. When I return I would have to go and borrow some to pay for my trip back. We need the authorities to look into the situation and ensure that there are no delays in the release of our monies.”

- Financial sector clean-up: 900 people dead, pay us by June 30 - GCFM customers to government

- Bank of Ghana governor denies calling NDC MPs hooligans

- Ghana to become top destination for fintech investments – BoG

- Here is why BoG suspended forex trading licences of GT Bank, FBN Bank

- Bank of Ghana, Development Bank Ghana to launch 3i Africa Summit in Accra

- Read all related articles