Introduction

Ghana’s economic growth is projected to hit 7.6% for 2019 with strong macroeconomic indicators and fiscal gains. Consistently, the country has seen some significant economic growth even though on the other hand cost of living of the ordinary Ghanaian has since been surging which of course makes it very worrying. Whereas there is supposed to be a direct correlation between economic/GDP growth/fiscal gains and living standards or cost of living of the people, it’s unfortunate that it is the opposite in the case of Ghana.

The big question one would ask is; WHY IS GHANA GROWING ECONOMICALLY ON PAPER BUT THE COST OF LIVING OF THE MAJORITY OF HER CITIZENS KEEPS SURGING?

The ordinary Ghanaian is told macroeconomic indicators are stable, within target and fiscal gains are sustainable yet the cost of living continuously keeps surging up, people are losing their jobs, government is increasing tariffs, transportation costs are rising and recently some significant increment in the communications service tax was implemented making it significantly more expensive to talk on the phone. Ideally the stable macroeconomic indicators, fiscal gains and the significant economic growth in GDP should generally guarantee or better still create a favorable economic environment for sustainable, affordable, rising living standards for Ghanaians without limiting this to increases in their income levels, purchasing power, job security, safe accommodation, education, healthcare and financial security but it’s not the case for Ghanaians and there is the pressing need to find out what is accounting for the rising cost of living. This is what this article sets out to examine.

Inflation

The recent financial sector clean-up has led to some significant job losses in the services sector of the economy and these have been accompanied by the huge job losses in the mining sector as a result of the campaign against illegal small scale mining in the country (The Operation Vanguard). All these, coupled with the persistent overflow of unemployment both in the formal and informal sectors of the economy can only put more pressure on families as the purchasing power of their money falls. Research also shows that about 35% of the employed workforce in Ghana earn less than GHS1, 000.00 each month and this can’t match the cost of living. With the recent upward adjustment in water and electricity tariffs as announced by the government, it is very obvious that the already difficult and expensive cost of living for the ordinary Ghanaian would be worsened by this action of the government. These would generally translate into increases in prices of goods and services and this is what is called inflation.

Source: BoG

Inflation has direct impact on standard of living of people in terms of expenses on food and non-food items, income, savings, loan and recreation over the period. Fortunately, Ghana’s inflation has seen decline since 2015 till date with single digit of 7.8 percent currently, but after remaining relatively low for all these months, the cost of living of citizens is surging up again, the reason being that inflation does not on its own determine the other key macroeconomic indicators. Other factors also contribute to the happenings.

Although inflation is single digits, interest rates are still very high and the local currency continues to depreciate in value which of course makes cost of doing business still expensive especially when the business is funded by loans. Businesses have to always battle with a depreciating cedi to buy dollars for their importation and finally transfer the cost to the consumer.

On the other hand of the coin, there is mostly a current account deficit because the economy is an import driven one and the narrative must change to an export driven if we want to reduce inflation and the rate at which our cedi is depreciating or better still, to appreciate against other currencies. I therefore recommend that government should pay attention to the agricultural sector of the economy in order to increase the supply of households’ food essentials and thus lower the cost of living.

Interest rates & Exchange rates

The cost of doing business in Ghana is still very high due to the high interest rates and persistent depreciation of the cedi even though the Bank of Ghana’s monetary policy rate has seen some decline over the last three years and is currently maintained at 16%.It is very worrying that commercial banks’ lending rates are still very high with an average rates of between 22% to 30%, making cost of borrowing high, access to funds less available and businesses finding it very difficult to repay back loans. Fundamentally, this is one of the key reasons why cost of living in Ghana is very high. This is because the overhead costs for these commercial banks are very high, looking at it from the perspective of utility bills, staff renumeration, ,non-performing loan provisioning, stationary cost and cost of funds (including borrowed foreign funds for their operations which must be paid back in foreign exchange0. The banks have no option than to transfer all these overhead costs to their customers.

Moreover, it’s evident that most of the things we use in Ghana are imported and these importers mostly borrow from the banks to import their goods and services, and pay huge taxes at the port before adding their profit margins and they eventually pass on all these costs to the final user, making it expensive to purchase the goods on offer. Note that cost of living automatically becomes high since the purchasing power of the ordinary Ghanaian reduces due to inflation and it is even worse when income levels of households are not increased over the same period.

Sadly, the Bank of Ghana’s reports show that loans and advances by the banking sector available for the sector that employs majority of Ghanaian i.e. Agriculture. Fisheries and Forestry are just 4.2% of total loans given, which in part explains why majority of Ghanaians are poor and can’t afford basic economic things like food and non-food items, transportation and utilities.,

Gross Domestic Product, GDP

Gross Domestic Product gives an idea of the total value of goods and services produced by all sectors of the economy of Ghana and this obviously has a direct relationship with the living standards of the people as it indicates how each of these sectors are performing. With this in mind, it is very clear why majority of the population in Ghana are trapped in the poverty web because the total contribution of the sector (into the GDP basket) that employs majority of the people which is Agriculture is very low.

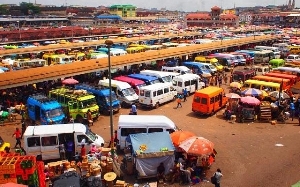

Ghana’s economic growth outlook is bright as it is projected to hit 7.6% by end of 2019. Non-oil growth is expected to significantly increase to 5.5% with the hope that the agriculture and service sectors would experience substantial growth. Agriculture and the service sectors by far employ (about 85%) majority of the Ghanaian workforce but the former’s contribution to GDP is only about 4.6% and this reveals why majority of the population are poor and their standards of living very low. Most people in these sectors especially the agricultural sector do not really gain much and a large percentage of their earnings go into food and non-food items, utilities and most importantly transportation.

It is important to emphasis the fact that wealth distribution is very much concentrated in oil and gas, mining, financial; services, commerce, manufacturing and politics and one would realize that these are run by individuals with specialized skills and knowledge.

But economic growth in Ghana is not supposed to be for just a specific few whilst the majority of the workforce are left with very small portion of the GDP gain to share. This explains why even though the economic growth outlook of Ghana is projected to hit 7.6% in a single calendar year the majority of her population do not have money in their pockets and thousands of families are living in abject penury in Ghana.

Conclusion

Ghana’s economic growth outlook on paper is fairly stable and very impressive but does not benefit the majority of her citizens as most of them are living in penury. One would have expected that these projected economic growth patterns and momentum ideally would translate into improvements in the pockets of the people and put the country on the right path to reducing poverty, making better living standards affordable and guaranteeing financial freedom but it’s rather the opposite. High level of youth unemployment, low productivity, continuous increase in utility tariffs, high talk tax rates prevail, and to worsen it all, high appetite for corruption that permeate through all the sectors of the economy especially among government appointees.

Government is recommended to begin a stakeholder engagement with all leaders in all sectors of the economy to amend where necessary and enhance where need be, public policies, change the narrative with respect to productivity, profitability and ownership of responsibility.Again,policy direction should be towards marginalized sectors to improve them and budget allocation should be focused especially on agriculture, production and manufacturing to make these sectors more growth oriented, to be able to employ the teeming youth workforce of our country