Recent years have seen a rise in the flow of real estate capital from advanced countries into Sub-Sahara Africa.

Globalization of real estate markets notwithstanding, the trend is characterized by a mis-matched of lack of growth in real estate markets analysis and research in the sub-region from both academic and industry sources.

Developments of standard market indicators such as rental growth, capital growth, price and rental indices, yields, total returns and market stock that are available in mature markets still remain available only in very limited markets in the sub-region.

Much of the works on Sub-Sahara African real estate markets takes viewpoint of investors from the advanced economies. It focuses on questions like the ability of new markets to meet the standards of professionalism and transparency required by inward investors.

In examining selected real estate markets in the continent – Ghana, Kenya, Nigeria, South Africa, Uganda, and Namibia – the paper makes an original contribution to the understanding of real estate markets potentials and in particular presents characteristics to confirm the uniqueness of each market. The research methodology is from a qualitative perspective and primarily relies on evidence from market reports and survey by the Global Transparency Index produced by Jones Lang LaSalle, Global Competitiveness Index by the World Economic Forum and Global Property Guide.

Evidence from the research suggests that real estate markets in Sub-Saharan Africa (with the exception of South Africa) share characteristics of emerging markets in terms of limited transaction data, low quality of data, transparency issues, valuation standards and the inactive participation of international market intermediaries.

A large increase in global real estate capital flows has, in the last decade, been a major factor increasing the transparency and information of a set of “emerging” real estate markets in Africa.

The size of higher-quality real estate investment stocks, in Sub-Sahara African markets (with the exception of South Africa) tends to suggest the markets are well outside the investment horizons of global investors. For the immediate future, therefore, the evolution of markets in the sub-region is likely to be largely driven by domestic rather than foreign capital flows.

Both information sources and published literature on African real estate markets are, on the whole, limited. With the partial exception of South Africa, there are few sources, and no long time series, of the market performance indicators which are the primary parameters to track conditions in mature markets.

However, the South African real estate market shares characteristics of mature markets in terms of data quality and transparency, valuation standards and the active participation of international market intermediaries. Real estate has always been an important part of a typical investment portfolio (Galaty, F.W; et. al.; 2015).

Real estate requires reliable and credible datasets, which are easily accessible as with all other asset classes. A careful market analysis to generate the required performance indicators is also critical.

Widely known as a long-

term asset class, real estate for example, in the US and UK as well as other mature markets has longer investment gestation period – 10 to 20 years or more, and also 3 typically delivers above average or high rates of return. In some markets, an impressive return can be achieved even after a relatively short period of investment.

In the context of this study, some qualities of real estate as an investment vehicle have been identified. Real estate has the ability to offer investors a greater control over their investments than other asset classes such as bonds, stocks, or securities. In addition, real estate marketplace consists of vendors and vendees who deal mostly directly with each other.

Further, investing in real estate requires an informed decision based on all relevant factors – property location, neighbourhood characteristics, title particulars, statutory requirements, and details of construction – as well as the market dynamics at the time of transaction.

It is also equally relevant to briefly discuss the downside of real estate as an investment asset. Huge capital is often required for real estate investment because it is an expensive venture to undertake.

Liquidity, an indication of how quickly an asset may be converted into money is also worth considering. Stocks and bonds are generally highly liquid than real estate over short term.

And because management decisions are needed in the life cycle of a real estate investment, it demands active management. Due diligence, an exploration of the rewards and burden from real estate investment is also a requisite in all transactions.

The stock of investible real estate represents a significant share of a nation’s wealth and productive capital. The stock of wealth and capital need to be carefully managed because it is both an important factor of production and an asset in the economy (Corcoran, 1987).

The performance of other investments – stocks and bonds – tends influence price changes of real estate assets in all economies because these are competing investment vehicles. Countries in the Sub-Saharan region lack active real estate investment markets.

To a large extent that the primary sources of market evidence, which shape real estate, research in the advanced economies and in a growing list of transitional and emerging economies are virtually non-existent in most economies. Limited firms of global intermediaries such as Investment Property Databank (IPD) and Knight Frank produce market indicators for real estate markets in few selected Africa countries.

Residential sector is predominantly one part of income producing real estate market. Though it is subject to fundamental demand, supply and leasing factors which varies from those of, for example, the office sector, the leading driving force is cash flow from the investment. Cash flow characteristic, in turn, generate the expected risk and return profile of real estate as an asset class (Anim-Odame, W.K., 2012).

It is conventional to treat real estate cash flows as a blend of fixed income and variable income (Hoesli and MacGregor, 2000; Geltner et. al, 2007). The fixed income element is the current rent payable by tenants which is typically fixed by lease contracts up to the next lease expiry or rent review.

This is essentially a bondtype income stream; the primary risk attached to it is that of tenant default. The variable income element is the rental payments which will apply following future lease expiries and rent reviews.

This element is subject to multiple risks, but the predominant risk is the variability in market rental prices over time, driven by shifts in the balance of occupier supply and demand. Risks which apply to the variable income element – market rentals, leasing, voids – are all heavily influenced by the state of the economy.

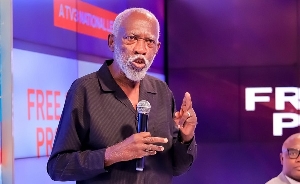

By Dr. Wilfred K. Anim-Odame , FGhIS, MRICS

(Source: Anim-Odame, Wilfred. (2016). Developing Real Estate Markets in Sub-Sahara Africa: The Fundamentals. Real Estate Finance. Volume 33. 26-32.)