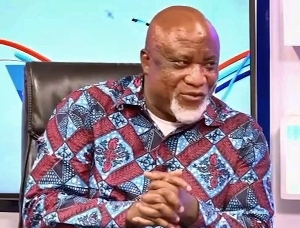

Governor of the Bank of Ghana, Dr. Ernest Addison

Governor of the Bank of Ghana, Dr. Ernest Addison

The central bank is expected to take action on insolvent Savings and Loans (S&Ls) companies and finance houses in the coming weeks; an exercise that will require about GH¢2billion to secure the funds of depositors.

There are currently 37 S&L companies and 23 finance houses operating in the country. While some remain very strong, there are a few with liquidity challenges and unable to meet their obligations to clients.

A source close to the central bank and the Finance Ministry told the B&FT that an announcement will be made by the central bank Governor, Dr. Ernest Addison, in a matter of days or weeks.

Such an action will see the Bank of Ghana move beyond ongoing reforms in the universal banking space into the other deposit-taking institutions for the first time.

The only challenge for the central bank, the source noted, is a decision on which module to use: either a purchase and assumption – whereby strong savings and loans companies will take up selected assets and liabilities of the insolvent ones; or consolidation of all the insolvent ones into a new S&L entity.

“Government and the central bank will make sure that no small depositor loses a penny, and the Bank of Ghana has been directed to come up with a plan to rescue the insolvent ones. Before the end of October, the plan should be out; and I am thinking it should be in a matter of days.

“At the moment we know of two options employed in the universal banks sector. First, the BoG got GCB Bank to take over UT and Capital banks, and that can be replicated here. Alternatively, they could resolve those which are challenged, put them together and form a new savings and loans outfit as was done for Consolidated Bank.

“The Bank of Ghana can also come up with an innovative third option, because the Banks and Specialised-Deposit Taking Institutions (BSDI) Act, 930 allows it to. We are looking at between GH¢1.5billion and GH¢2.5billion for this exercise,” the source noted.

A statement from the Ghana Association of Savings and Loans Companies (GHALSALC), which conceded that there is a period of uncertainty with some of its members, assured clients and the public that the sector remains in a good position to serve customers in the near- and long-term.

“The greater majority of members are stable, and customers should maintain their confidence in these institutions they have worked with over the years. Customers should therefore disregard publications and rumours which suggest that the savings and loans sector is collapsing.

“We are working closely with the Bank of Ghana to ensure we are positioned to achieve our core mandate, which is to bring good and reliable banking services to Ghanaians. For nearly 30 years, the savings and loans sector has been serving the Micro, Small and Medium Enterprises (MSMEs).

“We have been taking higher risks for our customers, and have been at the helm of economic development with innovative and tailored banking services. We therefore plead with our esteemed customers to maintain the level of faith and confidence reposed in us over the years, and for the general public to engage us in obtaining accurate information,” the statement added.

- Financial sector clean-up: 900 people dead, pay us by June 30 - GCFM customers to government

- Bank of Ghana governor denies calling NDC MPs hooligans

- Ghana to become top destination for fintech investments – BoG

- Here is why BoG suspended forex trading licences of GT Bank, FBN Bank

- Bank of Ghana, Development Bank Ghana to launch 3i Africa Summit in Accra

- Read all related articles