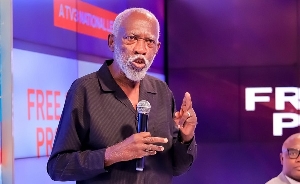

Private legal practitioner Ace Ankomah

Private legal practitioner Ace Ankomah

Private legal practitioner Ace Ankomah has said Ghana's laws allow the seizure of assets and properties of the directors and managers of the seven local banks that collapsed, and, in his view, that must be done.

Speaking at the Citi Business Forum on the theme: "Behind The Corporate Curtain; The Hidden Face of Corporate Governance", Mr Ankomah said: "The monies that have been lost to the state should be recovered from their assets", adding: "I hope that by now, their buildings, monies, shares in companies have been seized".

"If it is the law, we have it, defrauding by false pretences, stealing, corruption, fraudulent breach of trust, the laws exist", he stressed.

The Bank of Ghana, recently fused uniBank together with Sovereign Bank, The Royal Bank, The Beige Bank and The Construction Bank, to form a totally new local bank called Consolidated Bank Ghana (CBG) Limited.

On 20 March 2018, government announced the takeover of uniBank due largely to liquidity challenges.

Announcing the takeover, the Governor of the BoG, Dr Ernest Addison, said uniBank was currently insolvent.

KPMG was then named as Official Administrator to manage the bank for some months. The licences of the other banks were also revoked on grounds that some of them used suspicious information in acquiring them while others were insolvent.

Before the morphing of the five banks into CBG, the central bank, in August 2017, revoked the licences of two other local banks, UT Bank and Capital Bank, and were subsequently taken over by GCB Bank after having been declared "irredeemably insolvent" by the Bank of Ghana.

- Financial sector clean-up: 900 people dead, pay us by June 30 - GCFM customers to government

- Bank of Ghana governor denies calling NDC MPs hooligans

- Ghana to become top destination for fintech investments – BoG

- Here is why BoG suspended forex trading licences of GT Bank, FBN Bank

- Bank of Ghana, Development Bank Ghana to launch 3i Africa Summit in Accra

- Read all related articles