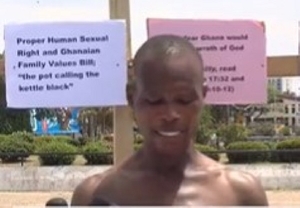

Samuel Sarpong and Dr Mark Nii Akwei Ankrah

Samuel Sarpong and Dr Mark Nii Akwei Ankrah

There appears to be another massive misappropriation of public funds at the State Housing Company Limited (SHC) allegedly perpetrated under the erstwhile National Democratic Congress (NDC) government.

This follows the reported stinking rot at the Social Security and National Insurance Trust (SSNIT) purportedly left behind by the former Director-General during the same regime.

An audit, sanctioned by the previous government following allegations of misapplication of public funds, found out that a total of GH¢10 million was lost in revenue during the administration of Samuel Sarpong, the immediate past managing director of the SHC.

His predecessor, Dr Mark Ankrah, is also said to have acted beyond his mandate to use the SHC to guarantee a loan for Proteus Ghana Limited.

Dr Ankrah allegedly committed the SHC to some financial obligations by “signing two procurement contract guarantees on 5th March 2014 with Eoliem Consulting FZE to secure a loan amounting to $2,600,000 for Proteus Ghana Limited, a contractor.”

A 300-page audit report claims that the GH¢10 million was lost in revenue “as a result of valuations not based on market values” of sold properties of the company.

The draft report says the previous management failed to do due diligence in the leasing of four plots of land at North Labone Estate in Accra.

The Internal Audit Agency audit, which started in January 2014 and ended in August 2017, identified three properties numbered 28, 29 and 30 that were offered to Keyport Realty for GH¢830,984 while another property of the company numbered 27 was offered to Gwakunda Engineering Limited for GH¢258,230, making a total of GH¢1,089,214.

The audit maintains that the properties leased to Gwakunda had an average market price of $750,000 (GH¢3 million) but was sold at GH¢258,230, leading to an estimated revenue loss of GH¢2,741,770.

The audit report also points out that three properties leased to Keyport Realty had an average market price of $750,000 (GH¢3 million each) but were sold at GH¢283,037 (an estimated revenue loss of GH¢7.7m), GH¢263,947 (GH¢2.7m estimated revenue loss) and GH¢284,000 (GH¢2.7m estimated loss) respectively.

“A total of GH¢10,910,786 is the estimated loss in revenue as a result of valuations not based on market values of the properties,” the report established.

It observes that SHC has no documented procedures in determining market values of properties before leasing to new lessees.

According to the report, the process of approval for sale, basis of valuation and vetting of bills on which the properties were leased to Keypot Realty and Gwakunda Engineering Limited were not made available to the audit team.

“Management should ensure that a well-documented property valuation procedure is established to determine market values of properties to be leased to new lessees by the company,”the auditors said.

It has also recommended to the new management to “obtain appropriate legal advice on the leasing of the affected property for possible renegotiation of the value to reflect current market price.”

Management, the report said, should also seek legal advice on the “breach of Section 203 of the Companies Code for appropriate legal sanctions to be taken against officers involved in the lease of the affected property.”

Mr Sarpong also went beyond his mandate in the valuation of a piece of land, which was sold to a company for almost half its official price, according to the auditors.

“A parcel of land was undervalued on 6th May, 2016 for issue with a sixty (60)-year lease at a cost of GH¢147,000. (o.21×700,00) to Meyiri Company Limited. The value was vetted and the bill of GH¢147,000 was sent to the client on 17th of May, 2016 for payment. The former MD (Samuel Sarpong), however, subsequently reduced the bill to GH¢75,000 on the 3rd of June, 2016 in a memo dated 27th May, 2016 without any justifiable reason.”

“This unilateral decision by the former managing Director resulted in revenue loss amounting to GH¢72,000 to the company,” the report stated.

The report held that Mr Sarpong “acted in outright disregard of the valuer’s professional advice and against the reviews and recommendations of the Internal Audit Unit and the General Manager, Operations.”

In the case of Dr Ankrah, the draft report noted that there was “neither both formal authorization and approval of the Board of Directors nor the Ministry of Works and Housing for the MD to commit SHC to guarantee the loan.”

The SHC entered into this deal with Proteus Ghana to build a number of houses on SHC lands at Adentan in areas called “Little London” and “Police Lands.”

The investment was intended to be recouped over a period of 60 years, according to the report.

- I will involve the police to deal with Kusi Boateng’s scandal – Ablakwa

- How GNPC CEO, board members, other officials increased their allowance by 150% - Ablakwa details

- Ofori-Atta's Databank, other bookrunners bagged GH¢875 million in 4 years – Adongo alleges

- Ambulance service sends delegation to cement depot seen in viral video

- Oil revenue management: PIAC demands prosecutorial powers

- Read all related articles