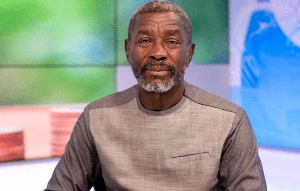

Business mogul, Prince Kofi Amoabeng

Business mogul, Prince Kofi Amoabeng

Business mogul and former owner of defunct UT Bank, Prince Kofi Amoabeng, has said that the central bank, Bank of Ghana, did not treat his financial institution fairly in the 2017 license revocation.

According to him, he was not given the opportunity by the central bank to present his case or negotiate a better deal.

This comes after the license of UT Bank and Capital Bank were revoked by the Bank of Ghana, and taken over by the GCB Bank.

Kofi Amoabeng, in addressing the matter in an interview on Accra-based Starr FM, said he felt sorry for the shareholders and staff of his bank, who lost their investments and livelihoods as a result of the revocation.

“My institution was treated unfairly. Left to me alone, I was fine but the shareholders, staff who earned their daily bread from the company, that is what pained me,” he said.

Narrating the circumstances that led to the revocation, Kofi Amoabeng explained that he was not informed of the reasons the BoG rejected his offer to recapitalise his bank, and that he had other alternatives that could have saved his bank from collapse.

To him, the revocation process was poorly handled, and that it did not consider the interests of the thousands of Ghanaian shareholders who had bought shares of his bank on the Ghana Stock Exchange.

“After the license was revoked I asked them what happened to the offer that they gave us and they told me that they had a letter from the Bank of Ghana that they didn't like our offer but the Bank of Ghana never wrote to us that they didn’t like our offer. If that was done, we could have forwarded our second offer because we had other alternatives.

“And the process is least much to be desired, we are talking about a bank that is publicly listed on the Ghana Stock Exchange with about 15,000 individual Ghanaian shareholders. You withdraw the license and then the stock exchange stops trading in those shares. At the time that they withdrew the license, the shares had some value, whether low or high. So, at least address us holistically but it was just withdrawn and it appeared they don't care about the shareholders and their shares,” he added.

NW/AE

You can also watch the latest episode of Everyday People on GhanaWeb TV below:

- Banking sector clean-up: Government allots GH¢4billion to pay customers

- LIVESTREAMING: Parliament commences investigations into defunct Gold Coast Fund

- Bank of Ghana has come under unfair criticism – Dr. Bawumia

- Banking Crisis: Owners of collapsed banks were money launderers – Allotey Jacobs alleges

- Do not panic, there are funds to cover all validated claims - SEC to aggrieved customers

- Read all related articles