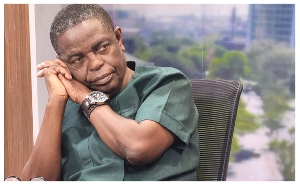

A tax analyst, Francis Timore Boi, has said the government’s implementation of the Emissions levy is unfair and sounds like a double-deck.

He explained that the government had introduced a similar levy in 2021, so introducing the same thing again in 2024 means the government is out to rip people off.

He said, as quoted by citinewsroom.com, “If in 2021, we were made to pay 10 pesewas and two years down the line you are now coming back with another tax, with the same objective, that we should pay, this time based on the engine capacity, that sounds like a double-deck and everybody will think that you know, you are not being fair to them.”

On February 1, 2024, the government introduced a new tax policy on carbon dioxide equivalent emissions on internal combustion engine vehicles.

The charges for the levy are based on the engine capacities of the various cars.

The tax analyst further intimated that there are no alternatives for people who may consider switching to electric cars.

He said: “The emission tax is supposed to lead to a change in behaviour, so there must be an alternative. The question is, what is the alternative here? We are being told about the electric vehicle. Let’s ask ourselves and let’s be sincere as a nation, how many electric cars do we have in Ghana? How many charging systems or infrastructure have we put in place to ensure that even when people bring the cars in, they’ll have that facility available?”

SSD/ ADG

Watch a recap of business stories below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Click here to follow the GhanaWeb Business WhatsApp channel