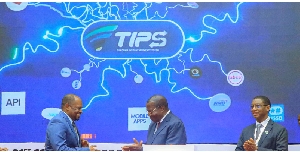

Vice President Philip Mpango, Finance deputy minister Hamad Chande (L) and Bank of Tanzania governer

Vice President Philip Mpango, Finance deputy minister Hamad Chande (L) and Bank of Tanzania governer

Vice President Phillip Mpango on Thursday called for urgent action to address the foreign exchange crisis.

He said the scarcity of foreign exchange needed quick interventions through medium and short-term solutions by financial sector players.

Among the interventions Dr Mpango proposed are exchange rate flexibility and some regulatory measures.

The Bank of Tanzania (BoT), the financial sector regulator, has reported the scarcity of foreign exchange since last year.

Dr Mpango said that although the country's financial sector had lately remained resilient to major global aftershocks, it was still vulnerable to headwinds.

Among them is the scarcity of foreign exchange, which is critically needed by the local importers and debt servicing.

Other challenges facing the sector include high loan interest rates, which, he suggested, should be reduced.

"The cost of loans in Tanzania remains high. It is not friendly to economic growth," he told the 23rd conference of financial institutions at the Arusha International Conference Centre (AICC).

"We should find ways to reduce the cost of loans and other financial services, especially to small and medium enterprises (SMEs)," he said.

He said the financial markets in Tanzania, like those in other developing countries, have been impacted by weak capital and increased debts.

"The solution lay in tight control of the financial markets in both the public and private sectors," Dr. Mpango explained.

The financial markets in Tanzania should not only be accessible to those desperately in need them but also attractive to investments, he stressed.

He went on, "Availability of soft loans is key to for economic growth. This is important more so in the wake of the global financial crisis".

He added that at a time a strong financial sector remained a catalyst for economic growth, many African countries, including Tanzania are facing foreign exchange scarcity crisis.

He attributed recurring liquidity crises to poor risk management and weak supervision and monitoring of the monetary sector.

Nevertheless, he said Tanzania received a positive credit rating from the international lending agencies for its economic outlook.

The two-day conference kicked off with official launching of Tanzania Instant Payment System (TIPS) which will ease financial transactions.

The facility, according to BoT Governor Emmanuel Tutuba, has already been linked to all banks and mobile money institutions.

Through the reduction of the burden of cash transfer and transaction costs, TIPs is among the solutions geared at migration to a cashless economy.

According to Mr Tutuba, payments amounting to Sh. 23 trillion were transacted in the country through digital payment last year.

TIPS is a collaborative effort between the central bank with the Treasury, the President's Office and the Tanzania Revenue Authority (TRA).

Other key players include the Tanzania Communication Regulatory Authority (TCRA), e-Government, Financial Services Deepening Tanzania (FSDT) and the Bill and Melinda Gates Foundation.

FSDT is a donor-funded financial sector market facilitator that aims to achieve poverty reduction through a transformation of financial solutions.

Mr Tutuba said despite the global shocks, the financial sector in Tanzania has remained resilient to the challenges.

Tanzania's economy, he explained, registered a 4.8 percent growth between 2020 to 2022 compared to 2.3 percent in the rest of the sub-Saharan African countries.

And between 2020 and 2023, inflation was estimated at 3.8 percent. He attributed this to tough monetary and fiscal policies employed.

According to the BoT boss, the Tanzanian financial sector registered a 9.2 percent growth in 2022, contributing 6.6 percent to GDP growth.

"The growth was monumental in that only 3.1 percent growth was registered in 2020 as was 2.2 percent contribution to the GDP," he told a fully-packed Simba Hall at the AICC.

Mr Tutuba further added that the launching of TIPs was a milestone in the migration towards cost effective digital payments.

Until January 31 this year it had been linked to 39 banks and six mobile communication companies and that it has eased interroperable transfers.

The Deputy Finance Minister, Hamad Hassan Chande, said that the launching of TIPs was within the framework of the financial sector development programme 2020/21 to 2029/30.

In recent years, the sector has seen a remarkable growth of assets, especially loans to the private sector and adoption of digital technologies.