Illustration of tax percentage

Illustration of tax percentage

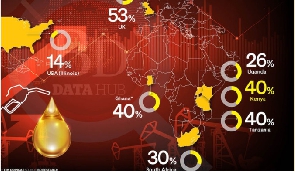

Though Tanzania has the cheapest fuel in the region, the ratio of taxes as a percentage of the pump price ties with Kenya at 40 percent. Ethiopia on the other hand does not tax fuel.

Kenya charges seven levies and two taxes on fuel and last week doubled Value Added Tax (VAT) on the commodity to 16 percent, further increasing the taxation component for every litre of super petrol, diesel and kerosene.

The United Kingdom (UK) is one of the countries with the highest taxes on fuel in the world, with taxes accounting for 53 percent of the pump price of every litre of gasoline.

Kenya ties with Tanzania but the two rank higher than Uganda whose taxation on fuel accounts for 26 percent of the cost of a litre of fuel.

The petrol cargo is also charged Sh20 million per vessel as customs processing fee, another Sh20 million per vessel as fee for Tanzania Shipping Agencies Corporation (Tasac), Sh7 million as Weights and Measures fee and Sh12.8 million per vessel as fee for Tanzania Bureau of Standards (TBS).

After paying that, the retail traders also have to incur transport cost, service levies to local authorities and other fees and profit margin for executive agencies, all adding up to the pump price.Kenya has the costliest super petrol in the East African region in the wake of the VAT revision, ahead of Uganda, Rwanda and Tanzania.

A litre of super petrol in Uganda is currently retailing at $1.362 followed by $1.303 in Rwanda and $1.186 in Tanzania. A litre of super petrol in Kenya is now retailing at $1.38.

In South Africa, a litre of super petrol is retailing at $1.176 while in Ghana it is going for $1.154.

Taxes and margins for oil dealers account for 40 percent of the cost per litre of fuel in Accra.