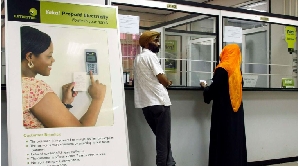

Umeme Customers making electricity payments at the Kampala Umeme branch in Uganda

Umeme Customers making electricity payments at the Kampala Umeme branch in Uganda

About a year to the expiry of Umeme Ltd’s electricity distribution concession, players in energy sector are divided over its legacy but united in saying its achievements and challenges offer vital lessons on the role of private sector in the country’s electricity production and distribution value chain.

The company’s 20-year power distribution agreement is scheduled to expire on March 31 next year after a government decision not to renew the contract. The power utility is listed on the Uganda and Nairobi Securities Exchanges.

Umeme’s exit is subject to government settlement of outstanding investment bills. Under the exit plan, the government intends to recapitalise the Uganda Electricity Distribution Company Ltd with $64 million. Another $200 million-$300 million budget is required for the compensation of existing Umeme shareholders, according to local sources.

So far, the company has invested more than $400 million in the refurbishment of the local electricity distribution network since 2015. Total capital investments made by Umeme fell from Ush231 billion ($59.5 million) in 2018 to Ush105 billion ($27 million) in 2019, according to the company’s annual report for 2022.

Total investments jumped to Ush279 billion ($71.8 million) in 2020 amid massive pressure exerted on the national power grid during the first Covid-19 lockdown period. Total network investments also fell from Ush123 billion ($31.7 million) in 2021 to Ush111 billion ($28.6 million) in 2022.

The company’s total revenues grew from Ush1.711 trillion ($440 million) in 2021 to Ush1.829 trillion ($470.8 million) in 2022 while operating costs rose from Ush240 billion ($61.8 million) to Ush247 billion ($63.6 million) during the same period under review.

Umeme’s profit after tax increased from Ush139 billion ($35.8 million) in 2021 to Ush148 billion ($38 million) in 2022. Umeme’s customer base is projected to increase from 1.459 million electricity users in 2023 to more than two million users this year, company data shows.

Around 95 percent of Umeme Ltd’s power users are served by the prepaid meter billing system. Total power losses dropped from 16.8 percent in 2021 to 16 percent in 2022.

In contrast, frequent power cuts point to the firm’s inability to achieve stable electricity supply patterns despite huge network investments.

Back in 2005, there were about 200,000 electricity consumers served by the former Uganda Electricity Board on the national grid.

The number has grown to nearly two million today. About 40 percent of the electricity supplied to the grid was lost every year but that number has reduced to less than 17 percent today.

Umeme proved to the market how viable it was to invest in the electricity distribution network in the past and this helped unlock more capital investments in the power sector. Umeme Ltd has invested more than $400 million in the electricity distribution network over time and that has attracted $2 billion in new power generation projects since the concession agreement was signed.

Dr Fred Muhumuza, an economist, observed that Umeme had poor service delivery caused by challenges in the upstream segment.

“But it eventually resolved most of them and that explains recent improvements in power supply in some areas. Umeme’s exit from the market will give way to reliance on government funds and electricity tariffs to expand the distribution network and this poses a big challenge to power consumers,” he said.

“The re-entry of government operations in Umeme’s space is likely to increase financing risk for the incoming electricity distributor. While Umeme Limited’s financing risk was restricted to business risk, the future government utility company will be exposed to both business and fiscal risks in the eyes of foreign lenders. This will translate into higher borrowing costs for the new utility operator.,” said Allan Lwetabe, Director for Investment Operations at Uganda’s Deposit Protection Fund.