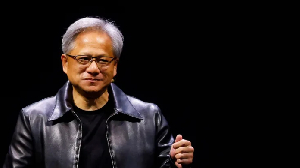

Many pipo dey call Nvidia boss Jensen Huang, wey be 61 years, di 'Taylor Swift of tech'

Many pipo dey call Nvidia boss Jensen Huang, wey be 61 years, di 'Taylor Swift of tech'

Nvidia na di most valuable company for di world afta dia share price climb well-well on Tuesday.

Dia stock end di trading day at nearly $136, e go up by 3.5%, wey make dem more valuable pass Microsoft.

Dis dey come afta dem overtake Apple earlier dis month.

Nvidia wey be American company dey make computer chips wey dey needed for artificial intelligence (AI) software.

Tori be say na di demand for dia products boost dia sales and profits ova di last few years.

Many investors believe say dia earnings fit grow even more, na wetin cause dia share price to rise, although some pipo dey questioned di-high valuation.

Tuesday share price rally mean say di market now dey value di company at $3.34tn (£2.63tn), wit dia price nearly double since di start of dis year.

Eight years ago, di stock bin dey worth less dan 1% of dia current price.

Rise and rise

Back den, Nvidia value bin come from dia competition wit rival AMD, for race to make di best graphics cards.

In recent years though dem dey benefit from a boom in demand for chips wey train and run generative AI models, di most popular na OpenAI ChatGPT.

Di firm also benefit significantly from a rush to mine Bitcoin for 2020, wey see a sharp uptick in sales of dia graphics cards.

Di rise and rise of di tech giant dey copy di increasingly high profile of dia oga, Jensen Huang.

Some say di 61-year-old electrical engineer na di "Taylor Swift of tech" sake of di celebrity status im don achieve.

Competition among AI developers dey very tough. Microsoft, Google-owner Alphabet, Meta and Apple na just some of di tech heavyweights wey dey battle to create a world-beating product.

Dis competition benefit Nvidia, wey dey dominate di vast majority of di AI chip market.

As such, investors believe say di company go continue to grow in value. Nvidia sales and profit figures don pass many analyst expectations in recent years.

For May, afta dem publish dia latest set of financial results, Quilter Cheviot technology analyst Ben Barringer say di company "once again don clear a very high hurdle".

"Demand no dey show any signs of switching off either," im add put.

However, some pipo dey more cautious.

For February, Barclays credit analyst Sandeep Gupta bin argue say Nvidia large market share go dey hard to maintain sake of di increasing number of rivals and im question how Nvidia customers go monetise AI software.