President John Mahama’s Big Push Agenda presents a bold vision for Ghana’s infrastructure, promising a $10 billion investment in roads, energy, health, education, and other critical sectors.

While this ambitious plan is crucial for economic transformation, its success will largely depend on how it is financed. Given Ghana’s current fiscal constraints and high debt levels, innovative and sustainable financing strategies are required to ensure that the “BigPush” does not overburden the country’s economy.

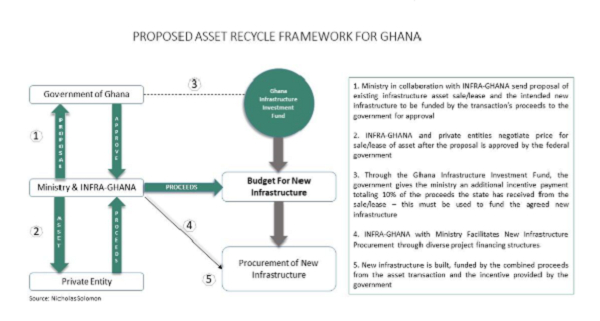

In this article, I discuss two strategies I believe can help streamline and finance deals. One of the most effective financing models Ghana can adopt is asset recycling, an approach that has been successfully implemented in countries like Australia.

This strategy involves privatizing select state-owned assets, reinvesting the proceeds into new infrastructure projects, and ensuring efficient management of funds through institutions like the Ghana Infrastructure Investment Fund (GIIF).

The other is what I term as INFRA-GHANA, a dedicated infrastructure procurement state agency, responsible for managing the PPP Act, researching & developing investable pipeline infrastructure projects, and procuring infrastructure assets on behalf of the government of Ghana.

Asset Recycling: Unlocking Capital for Infrastructure Growth

Ghana’s infrastructure is aging, and significant new investments are needed to bridge the gap. Raising additional revenue through increased taxation is one way to address this urgent challenge, but both the government and the public remain hesitant to take this route.

However, there is another approach—Asset Recycling. Infrastructure asset recycling involves the monetization of existing public assets through sale or lease to the private sector, with all funds received being reinvested in new infrastructure.

Asset recycling offers the opportunity to provide newly needed infrastructure without adding to public debt, all while maintaining or potentially improving existing infrastructure service delivery.

The Ghanaian government owns several high-value assets that can be partially or fully privatized to raise significant capital. Some key candidates for privatization or concession agreements include:

Electricity Company of Ghana (ECG) – A strategic partnership and equity release with and to a private operator could improve efficiency and unlock much-needed investment in Ghana’s power sector.

Kotoka International Airport (KIA) – Several global airport operators are seeking expansion opportunities, and a long-term lease or full privatization could generate billions for infrastructure development.

University of Ghana Medical Centre (UGMC) & Ridge Hospital – Converting these healthcare assets into concession agreements could enhance service delivery while freeing up government resources for new projects.

Table 1 Asset Recycling Framework Proposal

Conservatively, privatizing these three assets alone could raise more than a quarter of the $10 billion needed for Mahama’s Big Push Agenda.

How Asset Recycling Works

1.Partial or Full Privatization: The government sells part or all of a state-owned enterprise to private investors.

2.Ring-Fencing Proceeds: All revenue generated is deposited into a dedicated growth account to maintain capital value and prevent misuse.

3.Strategic Reinvestment: GIIF co-invests alongside private investors into de-risked infrastructure projects, ensuring maximum impact.

Establishing INFRA-GHANA

Ghana’s infrastructure gap remains one of the biggest obstacles to economic growth, industrialization, and job creation.

Roads, energy, water, and transport systems require significant investment, yet funding constraints, inefficiencies, and inconsistent procurement processes have slowed progress.

To attract private investment, ensure transparency, and deliver reliable infrastructure, the government must establish a dedicated Infrastructure Procurement, Development, and PPP Agency I call - INFRA-GHANA.

Similar to Infrastructure Ontario in Canada, INFRA-GHANA would serve as a centralized institution responsible for managing the PPP Act, structuring and procuring bankable infrastructure projects, and working alongside ministries to develop a pipeline of investment-ready projects.

This approach would address key challenges in Ghana’s infrastructure delivery, including:

1.Enhanced Efficiency & Accountability – A single agency dedicated to infrastructure procurement will eliminate bureaucratic delays, streamline project approvals, and enforce transparency in project selection and execution.

2.Attracting Private Investment – Investors seek clarity, consistency, and structured project pipelines.

INFRA-GHANA will provide a trusted framework for engaging sovereign wealth funds, institutional investors, and private developers to finance critical projects.

3.Strategic Infrastructure Planning – By coordinating across ministries, INFRA-GHANA can ensure infrastructure investments align with national development goals, rather than disjointed, politically driven projects.

4.Risk Reduction – Proper due diligence, feasibility studies, and risk allocation mechanisms will de-risk projects for both public and private stakeholders, ensuring long-term sustainability.

To deliver the BIG PUSH agenda, a dedicated agency like INFRA-GHANA is the bold step required.

Ghana can unlock billions in private investment, accelerate development, and secure a better future if we look more properly organised.

A Bold Vision, A Smarter Financing Approach

President Mahama’s Big Push Agenda is an essential step toward Ghana’s economic transformation, but its success depends on smart, new thinking, and sustainable financing.

Using the proposed asset recycling approach, creating a dedicated infrastructure procurement agency, and leveraging private sector capital, Ghana can build the infrastructure it needs without excessive debt burden.

Privatizing select state assets, ring-fencing proceeds, and attracting private investors will unlock billions in funding, allowing Ghana to achieve its development goals while maintaining fiscal stability.