One of the main aspects of the financial downturn in Europe is Greece’s inability to stabilize its economy. The country’s uncertainty attached to resolving its economic situation poses a greater obstacle to efforts in order to revive the economy.

Financial and investment experts are of views that though Greece’s economic crisis was as a result of accumulated debts and default in loan repayments, which was conceived at the time it planned joining the European Union, but suggested that Ghana is not too far from being the next victim of contagious economic crisis spreading to every sector of the economy.

Media Executive, Juliet Asante’s observation was that “in the lead up to its crisis, Ghana became a very expensive place to do business. Coupled with high inflation rates, the weak currency, power crises, high cost of money, poor infrastructure, doing business in the country has become quite the task.

Internally, businesses have been cutting down on hands. There has been quite a bit of employees’ unrest, a minor symptom of a problem that is unfolding. Within all of this mess, unemployment rates exceed 60%. This may correlate somewhat directly with the rise in crime, ultimately making Ghana an even un-safer place to do business”.

When borrowing becomes the only source of sustaining an economy, deficits emerge thus reduces debt repayment rating.

Evidently, most of the loans are denominated at foreign exchange. This foreign currency denominated loan may alter repayment plans due to higher inflation rate and depreciated value of cedi.

Kwesi Livingstone, Investment and Financial Expert, pointed out that leakages and inability of the government to a decentralized system may compromise the purpose of good governance.

Speaking with Ghanaweb in the interview, he pointed out that “the viability of a project is enough to repay a loan. The core of my point is that if we are taking a loan to finance a project, the project cash flow should be adequate enough to pay for the loan without putting strain on the other revenues. Currently, 80% of our revenue is going to recurrent expenditures, which means 20% is not enough to take care of other projects”.

He lamented that “If this vicious circle of approach continues, it would get to a point where the cash flow cannot support the loan repayment, we would enter into the same economic crisis with that of Greece, where we would now be the first to default the IMF loan. However, I am not against getting a loan to serve public interest, but there is other avenue to source for revenues, such as tax”.

Within this economic situation, there is little or no concentrated structure to project cash flow and monitor the feasibility of project in order to generate its own cash and make the loan repayment. When such controls are not in place, leakages would come in.

It means the loan granted for the project would not be equal to the amount for the project. This would compromise the quality of the project or incur higher rate for repayment of the loan.

Kwesi further noted that “if we look at the amount generated from the loan, without factoring the maintenance cost of that project that is to be taken, then we would be projecting less than we expected. If there are leakages, it puts more constrain on the project cash flow”.

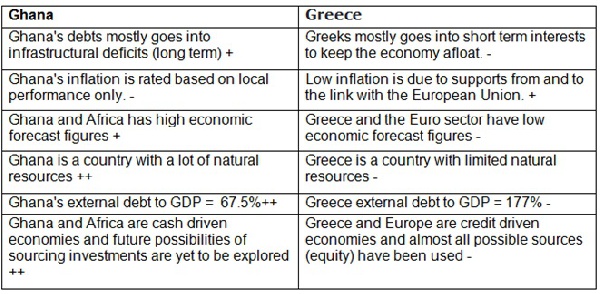

Nico Van Staalduinen, Executive Director of European Business Organisation, says: “although Ghana and Greece both have external debts, it is impossible to compare both countries, considering many factors that are either positive or negative. There is vast distinction when it comes to comparison. Greece hid debt and pushed, with the intention of containing and correcting thereafter, its inflation down to qualify for European Union membership”.

Economy Rating

Working within the guidelines of the European Union may have limited Greece’s effort to revive its economy. However, Ghana’s over borrowing must come with more measures to minimize expenditure and maximize its earning.

Kwesi further revealed that “now our debt GDP ratio is about 67.5%, which is not a debt itself but it has got a foreign exchange element. Even if government takes a loan, let say, of $1bn that should be paid back in 15 years from now, the dollar exchange rate would move in whatever amount it is now to equivalent amount at that time. It means as we are looking at the nominal value of the debt, we should also be looking at the exchange implication or impact of those debts”.

He concluded his opinion with advice that, “government should stop cheating with the wrong figures; they would always come out sooner or later. Wrong information comes with wrong remedies and solutions, which would not assist to tackle the real problem”.

With the pressure from more debts weighing on the economy, the country’s economy can only survive through tough austerity measures and makes it as a key priority to critically control leakages and consolidate robust fiscal programme. But as the election campaign draws nearer, it may be almost impossible to implement these measures because of the huge loads of burden that come with them, which could only have a negative implication on an average Ghanaian.

In other word, it means while fighting for the interest of Ghanaian populace for long-term benefits, the needs to resolve short term challenges become more important to the country. But for how long should we continue to dig more holes to fill others, an approach that placed Greece in its present position?