BlessingSteven Ackah discusses the global mining industry

BlessingSteven Ackah discusses the global mining industry

Ghana, a nation endowed with abundant mineral resources, has long been a key player in the global mining industry. From gold to bauxite and beyond, the country’s rich geological landscape presents a lucrative opportunity for economic growth. However, to fully harness and capitalize on these resources, there is a pressing need for strategic investment in exploration activities.

In this context, the establishment of an exploration fund under MIIF becomes paramount, not only to spur economic development but also to address historical challenges and ensure inclusive participation.

Historical Context

Ghana’s mining history is deeply intertwined with its economic narrative. The nation’s gold resources (No.1 producer of gold in Africa, and No.4 in the world), in particular, have fueled its economy for centuries. Despite this wealth, there has been a recurring challenge of limited local participation in the ownership and benefits of mining ventures. Foreign entities should see the importance of local content, thus, ensuring Ghanaians participate in the stake of this burgeoning industry.

The Exploration Fund Imperative

To rectify this historical imbalance and empower Ghanaians, the establishment of an exploration fund is crucial for the new critical minerals as developed exploration companies, mergers, and ventures prefer to invest in national funds to share risk and equity.

This fund would serve as a financial catalyst, enabling local individuals and entities to actively participate in exploration activities. By investing in exploration, Ghanaians can become stakeholders in the early stages of mining projects, thereby gaining a direct share in the subsequent economic benefits.

Current update:

LITHIUM RESERVES AROUND THE WORLD by CIC ENERGIGUNE

Russia, China, Australia Canada, Bolivia, Chile, Ghana, Congo, Spain, Portugal, Mali, Brazil, Mexico, Peru, Argentina, Germany, Finland, Kazakhstan, Czech Serbia, Austria, Zimbabwe, Namibia

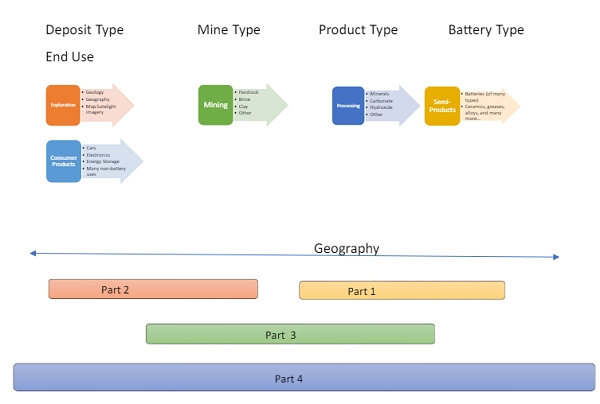

Linking geology and economics in the lithium industry. Mine-To-Market

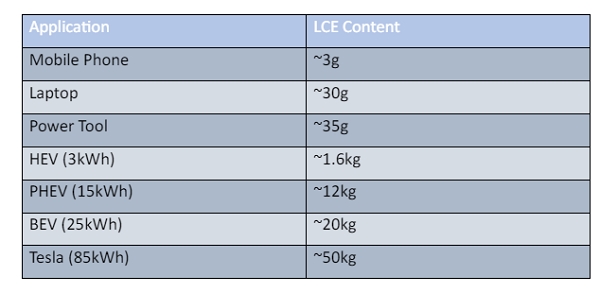

Lithium-ion battery consumption is in flux as well – switching to automotive from consumer applications.

Given this potential, Africa Government and Investors need to Commit to Exploration based on confirmed pegmatite bodies identified; 1 billion dollars is needed:

The establishment of an exploration fund in Africa should be accompanied by a strong commitment from the government to create a conducive regulatory environment. Clear policies, transparent licensing processes, and stringent environmental safeguards are essential components to attract both local and international investors to participate in exploration activities.

What’s in store for Lithium 2024? Pricing and Global Market Dynamics:

Following recent challenges in the lithium market, Ghana’s mining sector is undergoing a strategic review. Despite a global glut of lithium, Ghana’s leaders express confidence in the long-term prospects, emphasizing the increasing demand for lithium worldwide by 2030.

With declining spodumene prices affecting the industry, mining companies in Ghana is exploring cost-effective measures, such as prioritizing ore mining and considering temporary curtailment of operations to enhance productivity. The focus on reducing expenditure and overcoming seasonal challenges echoes new green minerals development agreement.

Fluctuations in the market, Ghana has not yet witnessed a surge in mineral exploration expenditure, which makes it difficult to reach unprecedented levels in 2024. Parallel to these developments, companies like AKOSDWOMO Mining and U2 SALT/ LITHIUM Company unveil ambitious lithium plans for 2024 to 2030, and strategic partnerships with developed mines to reshape the industry landscape.

Notably, Ghana experiences a notable entry into the lithium market, as prominent player Atlantic Lithium has collaborated with the government to receive the 1st mining lease this year. They aim to build the mine development by 2025 signalling Ghana’s increasing prominence in the global lithium sector.

These collective endeavours across the Ghanaian lithium sector align with the new critical minerals and energy transition projection of a substantial surge in lithium demand for nearby continents like Europe, anticipating a growth of 41 times by 2040. The unfolding developments set the stage for a dynamic and eventful year in 2024, emphasizing Ghana’s role in meeting the rising global demand for lithium.

The alteration to a global spotless energy system is set to drive a huge increase in the requirements for critical minerals, this means that some industry sectors such as energy and transport are emerging as major forces in mineral markets

Benefits of an Exploration Fund:

1. Empowering Local Participation: The exploration fund would empower Ghanaians to invest in and own shares of exploration ventures, fostering a sense of ownership and ensuring that the economic benefits of mining are more widely distributed within the local community.

2. Technology and Skills Transfer: Collaborating with international exploration firms through the fund can facilitate the transfer of cutting-edge mining technologies and skills. This not only enhances local expertise but also positions Ghana as a hub for innovation in the mining sector.

3. Risk Mitigation: Exploration inherently involves risks, both financial and operational. An exploration fund, carefully managed and strategically invested, can help mitigate these risks, ensuring a more stable and sustainable development of mining projects.

4. Economic Diversification: Investing in exploration expands the range of mineral resources that can be tapped, contributing to economic diversification. This not only safeguards against fluctuations in commodity prices but also positions Ghana as a resilient player in the global market.

5. Wealth Redistribution: Ghana’s mineral wealth is often concentrated in the hands of a few multinational corporations. An Exploration Fund would help redistribute this wealth more equitably, ensuring that the benefits of resource exploitation reach a broader segment of the population. This, in turn, could mitigate social inequalities and contribute to poverty reduction.

6. Economic Diversification: Relying heavily on a single sector, such as mining, poses economic risks. An Exploration Fund could encourage diversification by supporting exploration activities in untapped areas or new minerals. This diversification would make Ghana’s economy is more resilient to fluctuations in global commodity prices, providing stability and long-term sustainability.

Challenges in Exploration Activities:

1. Financial Constraints:

Exploration is a capital-intensive endeavour, and many local businesses face challenges in securing sufficient funding. An Exploration Fund would alleviate financial constraints, enabling entrepreneurs to undertake geological surveys and prospecting activities crucial for discovering new mineral deposits.

2. Technological Gaps:

Keeping up with advancements in exploration technologies is essential for successful prospecting. The fund could be utilized to bridge technological gaps by providing training programs and access to modern exploration tools, ensuring that Ghana remains competitive in the global mining landscape.

3. Environmental and Social Responsibility:

Exploration activities must adhere to environmental and social standards. The fund could support initiatives promoting responsible mining practices, ensuring that exploration endeavours prioritize environmental conservation and respect local communities, fostering sustainable development.

In summary: The global & economics of lithium.

Lithium demand is rising fast, driven by a wide range of battery applications, which are in turn changing the structure of demand, the lithium supply chain and potentially raw material requirements – although much remains uncertain;

Geologically ‘brine’ salars and ‘hard rock’ pegmatites remain the most important lithium deposit types in terms of producing and undeveloped resources, however, there are some interesting emerging sedimentary / clay deposits and unconventional brine concepts – and lithium remains very ‘under-explored’ globally.

Spodumene pegmatites in Ghana are the fastest-growing source of supply, however, long-term competitiveness may be dependent on successful downstream integration targeting the battery industry.

A case study concept of a Western Australian ‘Lithium Valley’ is possible for Africans and investors to adopt, despite the high cost, due to the number of quality mines, proximity to Asia, and the unit reduction in freight cost associated with the low-grade spodumene concentrate. In addition to the ‘cluster effect’ of many minerals’ businesses, specialists, and students.

The ‘green’ association of lithium use presents a challenge of ‘strategic coherence’ to explorers and miners impacting decisions around exploration, mining, investors, stakeholders, and leadership;

But remember, we are in an unsustainable ‘lithium boom’ of high prices and high-volume growth- future long-term growth of the industry is reliant on structurally lower prices, and thus structurally lower cost.

Conclusion

As Ghana looks towards the future, establishing an exploration fund is a pivotal step in unlocking the full potential of its mineral wealth. Ghana can position itself as a leader in responsible and sustainable mining practices by fostering local participation, mitigating risks, and embracing technological advancements.

The commitment to invest in exploration activities addresses historical challenges and paves the way for a more inclusive and prosperous mining industry that benefits all stakeholders. Today, plans are underway to bring 8 African Countries to Join one of the finest Precious Stone and Exploration Funds in Europe.

The establishment of this setup between the fund company and an Exploration Fund in Ghana is not merely an economic strategy but a pivotal step towards inclusive development. By empowering local participation, redistributing wealth, and addressing challenges associated with exploration activities, Ghana can unlock its full potential, fostering a resilient and sustainable future.

Thank You.

Steven Blessing Ackah.

info@ghanagoldexpo.org