The PURC's decision to implement these hikes followed extensive investment hearings

The PURC's decision to implement these hikes followed extensive investment hearings

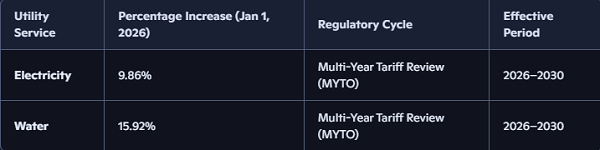

The onset of the 2026 fiscal year in Ghana has been defined by a profound regulatory and macroeconomic contradiction. On January 1, 2026, the Public Utilities Regulatory Commission (PURC) implemented a significant upward adjustment in utility tariffs, raising electricity prices by 9.86% and water tariffs by 15.92%. This policy move arrived precisely as the Ghanaian economy emerged from a year of remarkable currency recovery.

Throughout 2025, the Ghanaian cedi (GHS) defied historical trends by appreciating substantially against the United States dollar (USD), transitioning from a period of extreme volatility to becoming one of the continent's best-performing currencies. The intersection of rising domestic utility costs and a strengthening local currency presents a complex analytical challenge for policymakers, industry leaders, and civil society.

This report provides an exhaustive examination of these tariff changes, utilising the framework of Technocratic Social Developmentalism as articulated by the Common Purpose Alliance Ghana (CPAG) and its Chief Executive Director, Y.K. Amakye Ansah-Yeboah.

By applying the "good governance matrix," the analysis explores the technical, philosophical, and socio-economic drivers of the 2026–2030 Multi-Year Tariff Order (MYTO) and its specific implications for the competitiveness of Ghana’s industrial sector.

The Regulatory Framework of the 2026–2030 Multi-Year Tariff Order

The January 1, 2026, tariff increases are not isolated adjustments but the result of the major Multi-Year Tariff Review (MYTO) process mandated under the PURC Act, 1997 (Act 538). This regulatory cycle, typically occurring every three to five years, is distinct from the quarterly tariff adjustments that focus solely on operational fluctuations such as fuel prices and inflation.

The 2026–2030 MYTO represents a comprehensive evaluation of the total investment requirements, capital expenditure (CAPEX), and the regulated asset base of Ghana’s primary utility providers, including the Volta River Authority (VRA), the Electricity Company of Ghana (ECG), and the Ghana Water Company Limited (GWCL).

The PURC's decision to implement these hikes followed extensive investment hearings, stakeholder consultations, and regional public forums held across the country in late 2025. According to the commission, the primary drivers for the electricity adjustment included the rising cost of power generation, a heavy reliance on thermal energy, and the significant capital requirements for network expansion.

For the water sector, the commission pointed toward the high cost of raw water treatment, exacerbated by illegal mining pollution, and the urgent need to address non-revenue water (NRW) levels.

The commission emphasised that while the tariffs are approved for a five-year window, they remain subject to quarterly reviews to reflect changes in macroeconomic variables that fall outside the utilities' direct control.

These variables include the GHS/USD exchange rate, domestic inflation, and the generation mix between hydropower and thermal energy.

Macroeconomic Context: The 2025 Cedi Appreciation and the Currency Paradox

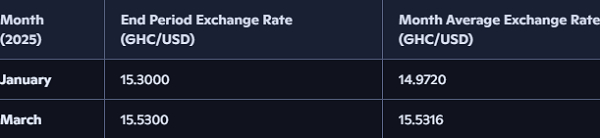

The most striking aspect of the 2026 tariff hike is its timing relative to the performance of the Ghanaian cedi. In 2025, Ghana experienced a significant currency rebound that provided a buffer against imported inflationary pressures. By mid-2025, the cedi had appreciated approximately 30% against the US dollar, recovering from rates as high as GH¢15.56 per USD in early 2024 to approximately GH¢10.28 by June 2025.

This appreciation was driven by a combination of targeted interventions by the Bank of Ghana, including a US490 million injection into the market in April 2025, and a general weakening of the US dollar index.

Furthermore, the successful implementation of the gold-for-reserves and gold-for-oil programs helped stabilise gross reserves, which approached US$11 billion by the end of the year.

Despite this favourable currency environment, the PURC's tariff determination for 2026 utilised an exchange rate benchmark of GH¢12.0067 per USD.

The discrepancy between the mid-2025 market rates and the PURC’s 2026 benchmark suggests a cautious regulatory approach. The commission argues that the MYTO must preserve the real value of tariffs over a five-year horizon, necessitating a benchmark that accounts for potential future volatility rather than just spot market gains.

However, consumers and the industrial sector have criticised this logic, suggesting that the benefits of the 2025 appreciation should have resulted in a tariff reduction or, at the very least, a freeze on current rates.

Technocratic Social Developmentalism: The CPAG Analytical Framework

The Common Purpose Alliance Ghana (CPAG), led by Y.K. Amakye Ansah-Yeboah, provides a distinctive ideological lens through which to analyse the 2026 tariff adjustments. This framework, termed "Technocratic Social Developmentalism," rejects the neoliberal orthodoxy that often dictates utility management in developing nations.

Ansah-Yeboah characterises the current state of Ghana's utility sector not as a failure of state ownership, but as a "Tragedy of Neoliberalism" caused by an over-reliance on external donor prescriptions and market-based solutions that ignore national developmental priorities.

At its core, Technocratic Social Developmentalism argues that public utilities should be managed by technical experts (technocrats) who are insulated from partisan political interference and the conditionalities of international financial institutions. The framework emphasises "Strategic National Autonomy" and "Good Governance" through a matrix of institutional reforms that prioritise accountability and technical efficiency over privatisation.

The Good Governance Matrix and Utility Reform

The "good governance matrix" proposed by Ansah-Yeboah and CPAG includes several critical practices designed to transform the Electricity Company of Ghana (ECG) and other utilities into self-reliant, efficient entities. These practices focus on internal discipline and the elimination of what CPAG describes as "neocolonial" economic structures.

1. Digital Sovereignty and Transformation: Leveraging technology to eliminate human error, waste, and corruption. This includes the upgrading of Supervisory Control and Data Acquisition (SCADA) systems and the implementation of automated billing to reduce commercial losses.

2. Efficiency-Led Pricing: Moving away from the neoliberal model of "cost-reflective" pricing—which often passes the cost of systemic inefficiencies and currency depreciation onto the consumer—toward a model where tariffs are determined by optimised operational costs and technical benchmarks.

3. Renegotiation of Power Purchase Agreements (PPAs): Addressing the high cost of generation by revising unfavourable contracts with Independent Power Producers (IPPs). In November 2025, Parliament ratified several revised PPAs to reduce future capacity charges.

4. Institutional Insulation: Protecting utility management from the "distortions of partisan politics" and ensuring that technical decisions regarding the energy mix and procurement are made by experts rather than politicians.

Through this lens, the 9.86% and 15.92% tariff hikes are viewed with scepticism. CPAG argues that if the good governance matrix were fully applied—specifically in reducing technical and commercial losses and eliminating "leakages" in the revenue cycle—the need for such substantial price increases would be mitigated.

Technical Drivers and Macroeconomic Assumptions of the 2026 Tariff Increase

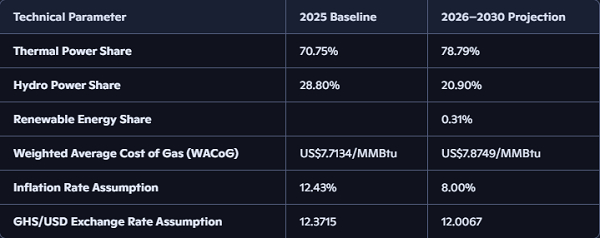

The PURC's 2026–2030 MYTO is built upon a series of technical projections and macroeconomic assumptions that illustrate the underlying challenges of Ghana's utility landscape. The commission's justification for the 9.86% electricity hike is deeply rooted in the structural realities of the national energy mix.

The Energy Generation Mix and Cost Drivers

For the 2026–2030 period, Ghana's energy generation is projected to become increasingly reliant on thermal sources. Thermal generation is expected to account for 78.79% of the total mix, while hydropower's share is projected to decline to 20.90%. This shift is significant because thermal power relies heavily on natural gas, which is priced using the Weighted Average Cost of Gas (WACoG).

The PURC has approved a WACoG of US$7.8749 per Million British Thermal Units (MMBtu) for the new tariff period, an increase from the 2025 baseline.

The high cost of thermal generation is a primary reason why electricity tariffs remain elevated despite currency stability. Natural gas procurement remains largely dollar-indexed, meaning that even a stable cedi at 12.00 per USD still represents a significantly higher cost of production than in years when the rate was lower.

The Water Sector and Environmental Challenges

The 15.92% water tariff increase is driven by even more acute operational pressures. The Ghana Water Company Limited (GWCL) has reported a massive increase in the cost of chemicals required to treat raw water. This is directly linked to the pollution caused by illegal mining (galamsey), which has increased the turbidity of water sources beyond the design capacity of many treatment plants. The Consumer Protection Agency (CPA) has criticised this, arguing that consumers are being forced to pay for the government's failure to regulate illegal mining.

Furthermore, the PURC has highlighted the issue of non-revenue water (NRW), which includes both technical leakages and commercial losses through illegal connections. The NRW level is projected to remain at approximately 43% during the tariff period, representing a significant financial drain that must be covered by paying consumers.

Pros and Cons Analysed Through Technocratic Social Developmentalism

The 2026 tariff adjustments provide a complex set of trade-offs when evaluated through the CPAG framework. While the PURC views the hikes as essential for "financial sustainability," Ansah-Yeboah's matrix emphasises "social equity" and "strategic national autonomy".

Pros: Ensuring Utility Viability and Long-Term Stability

From a technocratic perspective, the 2026–2030 MYTO offers several potential benefits for the utility sector's infrastructure and long-term health:

1. Support for Capital Expenditure (CAPEX): The review allows utilities to secure the funding necessary for network expansion and reliability. ECG, for example, invested approximately $408 million between 2022 and 2024 in system reliability and technical loss reduction. The new tariffs provide a revenue stream to continue these vital investments.

2. Implementation of Digital Reforms: Higher revenue enables the continued rollout of the SCADA systems and the Digital Transformation drive, which have already shown results in improving supply quality and rapid fault rectification.

3. Universal Access Support: The MYTO introduces a new mini-grid tariff system to support electricity supply to remote and island communities. By including these costs in the VRA’s revenue requirement, the regulator aims to achieve universal access by 2030.

4. Regulatory Discipline: The use of a cost-reflective framework aligns Ghana with other reform-oriented markets like Kenya and South Africa, potentially making the sector more attractive for transparent, non-predatory investment.

Cons: The Erosion of Social Welfare and Economic Sovereignty

The Technocratic Social Developmentalism lens also identifies significant risks and drawbacks associated with the January 2026 hikes:

1. The Tragedy of Neoliberal Pricing: Ansah-Yeboah argues that forcing domestic consumers to absorb the costs of "neocolonial" energy structures—such as dollar-indexed gas and expensive foreign IPPs—is a betrayal of the social contract. This model prioritises the financial returns of external partners over the living standards of Ghanaians.

2. Erosion of Wage Gains: The 9.86% and 15.92% hikes coincide with the implementation of a 9% increase in the national minimum wage. The Trades Union Congress (TUC) has correctly pointed out that the tariff increases effectively wipe out the value of the 2026 pay rise, leaving workers in a worse financial position than in 2025.

1. Passing on Inefficiency Costs: The 43% non-revenue water level and the persistent technical/commercial losses in the power sector suggest that a significant portion of the tariff hike is used to cover waste rather than productive investment.

2. Disincentivising the 24-Hour Economy: As the government pushes for a 24-hour economy to boost productivity and jobs, the high cost of electricity for commercial and industrial users serves as a major barrier to implementation.

Impact on Ghana’s Industrial Sector Competitiveness in 2026

The competitiveness of Ghana’s industrial sector for the 2026 fiscal year is perhaps the most critical concern arising from the PURC’s tariff announcement. Industry leaders, represented by the Association of Ghana Industries (AGI) and the Ghana Union of Traders Association (GUTA), have warned that the cumulative effect of high utility costs, combined with persistent structural challenges, could lead to a "strategic relapse" in manufacturing.

The "Death Zone" of Manufacturing Costs

A detailed analysis of industrial electricity costs reveals a stark reality. Between 2018 and 2022, Ghana managed to lower tariffs from $0.18/kWh to approximately $0.11/kWh, briefly reaching regional competitiveness. However, by 2025, that trend reversed, with rates trending back toward $0.16/kWh.

Economic modelling suggests a "Death Zone" for manufacturing, defined by the distance between Ghana’s electricity costs and the global standard maintained by competitors like Vietnam and China (approximately $0.07/kWh). With Ghana’s current positioning, the gap is over 100%, making it nearly impossible for energy-intensive industries to compete on the global stage.

The 24-Hour Economy and the Cost of Power

The flagship 24-Hour Economy policy is designed to encourage round-the-clock operations in manufacturing and logistics to reduce unemployment and stimulate growth. However, working through the night requires higher electricity consumption. The AGI has noted that for a business running 24 hours, the 9.86% hike under normal conditions is significant, but when combined with extended production hours, the actual cost impact on the bottom line is amplified.

Industries such as plastic manufacturing, which are already facing increased taxes, have warned that they will have no choice but to pass these costs onto the consumer, fueling a cycle of cost-push inflation. This undermines the very objective of the 24-hour economy, which is to lower the cost of living through increased productivity.

Regional Comparison: The AfCFTA Context

Under the African Continental Free Trade Area (AfCFTA), Ghana’s industrial sector must compete directly with its neighbours. Ivory Coast, for example, has a power score of 1.99—higher than the African average—and benefits from a more stable energy mix. Ghana’s tariffs are currently higher than those in subsidised systems like Nigeria, but lower than smaller, inefficient grids in Liberia or Sierra Leone.

The PURC maintains that by aligning commercial and industrial tariffs with the continental average, Ghana preserves its competitiveness for businesses. However, the industrial sector argues that being "average" in a continent with the world's highest electricity costs is not sufficient for an export-led transformation.

Social Implications and the Labor Confrontation

The 2026 tariff adjustments have created a significant rift between the government and Organised Labour. The TUC has expressed "outrage" over the timing of the increases, describing them as the "Government's New Year's gift to Ghanaians".

Erosion of Real Wages

The 9% increase in the minimum wage and base pay, which also took effect on January 1, 2026, was intended to provide relief to workers struggling with high living costs. However, the TUC has calculated that the 9.86% and 15.92% utility hikes will completely erode these gains. In 2025, workers received a 10% wage increase while utility tariffs rose by more than 18%, and the 2026 situation appears to be a repeat of this trend.

| Year | Wage Increase | Cumulative Utility Tariff Increase | Net Impact on Worker | | :--- | :--- | :--- | :--- | | 2025 | 10% | > 18% | Negative | | 2026 | 9% | ~12.5% (Weighted Average) | Negative |

Labour leaders have warned that they will mobilise workers to resist the implementation of these "obnoxious" increases unless the government returns to the negotiating table to top up the 2026 wage increase.

This tension highlights the conflict between the financial needs of state utilities and the socio-economic survival of the workforce—a conflict that the Technocratic Social Developmentalism framework seeks to resolve through efficiency-led pricing and institutional accountability.

The Compound House Poverty Trap

The 2026 tariff structure continues the use of block tariffs for residential consumers. While this includes a "lifeline" rate for low-income households, many urban poor live in "compound houses" where multiple families share a single meter. Their combined consumption often pushes them into the highest tariff bands, meaning the poorest Ghanaians are often paying the highest per-unit rates for electricity.

This structural inequity is a primary focus of CPAG’s critique, arguing that neoliberal regulatory models fail to account for the unique social structures of the Ghanaian populace.

Institutional Reform vs. Privatisation: The ECG Case Study

A core component of the "Technocratic Social Developmentalism" argument is that state management, when empowered by technical discipline, can outperform the market. The Electricity Company of Ghana (ECG) serves as the primary battleground for this ideological debate.

International financial institutions have projected that ECG’s debt could escalate to $9 billion by the end of 2026 if structural shifts are not enacted. Neoliberal advocates use this projected insolvency to argue for privatisation or aggressive tariff hikes. However, CPAG and Y.K. Ansah-Yeboah argue that ECG has already demonstrated significant progress through internal reforms that align with technocratic principles.

1. Revenue Improvement: Between December 2024 and June 2025, ECG recorded a 66.6% increase in monthly revenue collection, from GH¢970 million to GH¢1.61 billion.

2. Network Investment: The utility invested $408 million in network capacity and expansion between 2022 and 2024. 3. Loss Reduction: Technical and commercial losses were reduced from 28.41% in 2022 to 27.05% by the end of 2024.

These improvements, Ansah-Yeboah argues, should be used to internalise costs and provide relief to consumers rather than being used to justify the next round of neoliberal price hikes. The "good governance matrix" suggests that if technical discipline were applied to fuel procurement and PPA renegotiations, the utility sector could achieve financial stability without overburdening the industrial base.

Future Outlook: Navigating the 2026 Fiscal Year

As Ghana navigates the implementation of the 2026–2030 MYTO, the economy stands at a crossroads. The government’s commitment to macroeconomic stability and the "Big Push" infrastructure agenda remains strong, but the rising cost of core utilities threatens the viability of these transformative goals.

The Path to Industrial Independence

The high cost of grid power is driving a shift toward decentralised energy solutions. For the industrial sector, the "New Logic" of 2026 is to view the grid not as a reliable service, but as a source of volatility and financial risk. Many businesses are now borrowing to invest in solar and microgrid systems, effectively "swapping" a utility bill for a capital investment loan.

The government could support this transition by zero-rating imports of solar panels and batteries, thereby lowering the barrier to entry for industrial self-generation. This would align with the technocratic goal of national self-reliance while providing a permanent fix to the manufacturing "Death Zone".

Regulatory Discipline and Social Equity

The PURC has pledged to continue its quarterly tariff reviews to protect utilities from "unexpected cost increases" while ensuring consumers are not "overburdened". However, the 2026 experience suggests that the current regulatory model may be too heavily weighted toward the financial requirements of utilities and their external creditors at the expense of domestic productivity and social welfare.

A more balanced approach, as suggested by the Technocratic Social Developmentalism matrix, would involve a moratorium on foreign IPP contracts, a rigorous audit of energy sector debts, and the redirection of efficiency gains toward industrial subsidies.

Conclusion

The January 1, 2026, utility tariff increases represent a fundamental challenge to Ghana’s developmental trajectory. While the 9.86% electricity and 15.92% water hikes are technically grounded in the requirements of the 2026–2030 MYTO and the structural costs of thermal generation, they exist in sharp tension with the currency appreciation of 2025 and the industrial goals of the 24-hour economy.

Through the lens of CPAG and Y.K. Ansah-Yeboah’s Technocratic Social Developmentalism, these hikes are a symptom of a deeper systemic reliance on neoliberal pricing models that fail to prioritise national sovereignty and industrial competitiveness.

The "good governance matrix" provides a roadmap for reform that emphasises technical accountability, digital sovereignty, and the restructuring of the energy sector’s cost base to ensure that utility services remain a prerequisite for economic participation rather than a barrier to it.

For the industrial sector, 2026 will be a year of adaptation. Whether through decentralised generation or intensified advocacy for tariff reform, businesses must find ways to cross the "Death Zone" of high energy costs if Ghana is to realise its potential as a regional manufacturing hub.

The success of the Ghanaian economy in the coming years will depend on whether the state can move beyond the "Tragedy of Neoliberalism" and establish a utility regime that is truly "Technocratic, Social, and Developmental".