The 2025 Budget is set to be presented to Parliament on March 10, as proposed by the Ministry of Finance. This date is subject to approval by the House, and the budget must be presented before March 31, 2025, as per the Financial Administration Act.

In preparation for the budget, the Finance Ministry has sent guidelines to various ministries to aid in spending targets and program inputs. Ministers have been asked to prioritize their spending plans and programs for 2025, with the aim of rationalizing expenditure and reducing the country's debt stock.

The government plans to use the 2025 Budget to kick-start economic recovery and job creation through its flagship programs. Some of the key focus areas include:

- *Economic Recovery*: The government aims to stimulate economic growth and create jobs through various initiatives.

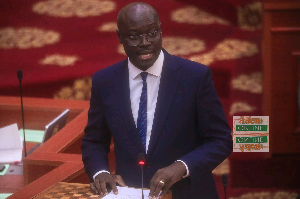

- *Tax Reforms*: The Minister of Finance, Dr. Cassiel Ato Forson, is expected to propose the removal of taxes such as the betting tax, COVID-19 levy, and E-Levy. However, this could create a significant revenue gap that needs to be addressed.

- *Energy Sector Reforms*: The government plans to address energy sector debt, which could impact Ghana's economic recovery.

The 2025 Budget will also be influenced by Ghana's ongoing program with the International Monetary Fund (IMF), ensuring that policies align with IMF guidelines. The IMF team is currently in Ghana engaging with the government on budget preparations.

Source:Adomonline