Whoever becomes the next president of Ghana is facing a significant challenge.

Over the next four years, the victor of Saturday's election must repay over 30 billion cedis ($2 billion) in debt. He must accomplish this while the government is still unable to access capital markets.

Refinancing the load will depend on stabilizing a currency that has fallen more than 60% against the dollar in three years and reducing the rate of inflation in Africa's largest gold producer.

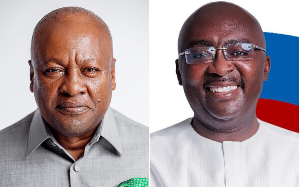

The 33 million-person country is incensed at the rising costs of essentials like plantains, onions, and banku, a dough made from fermented corn and cassava. According to the majority of opinion surveys, opposition leader John Dramani Mahama will defeat Mahamudu Bawumia of the ruling party.

Mahama, who lost the position in 2017, would be making a Donald Trump-like comeback, continuing the three-decade trend of switching terms between the two major parties.

According to bankers and financial managers we met with in Accra, the next leader will need to reduce the current 23% growth in consumer prices to less than 15%. That might persuade the central bank to lower interest rates and allow the next government to access the local market.

The government of President Nana Akufo-Addo has been raising money by selling short-term securities after investors were put off by a restructuring of local currency debt.

Repayment Schedule

Ghana has to repay $9 billion of debt by 2038

Source: Finance Ministry, Bloomberg