The Bank of Ghana (BoG) has brought out a list of financial institutions that are unlicensed to carry out deposit taking activities in the country.

This follows the high levels of uncertainty that have hit the banking sector and its institutions in recent months.

In the past few months, a number of banks have been caught up in this web, rendering their customers hapless in retrieving their investments.

Recently, Menzgold was in the news following disagreements with the Bank of Ghana (BoG) regarding its operations.

The gold dealership firm has since been ordered to shut down its gold trading activities by the Securities and Exchange Commission (SEC).

Meanwhile, seven indigenous banks have already collapsed in the last two years after being deemed financially insolvent. These include UT Bank, Capital Bank, Beige Bank, Sovereign Bank, Royal Bank, Construction Bank and UniBank.

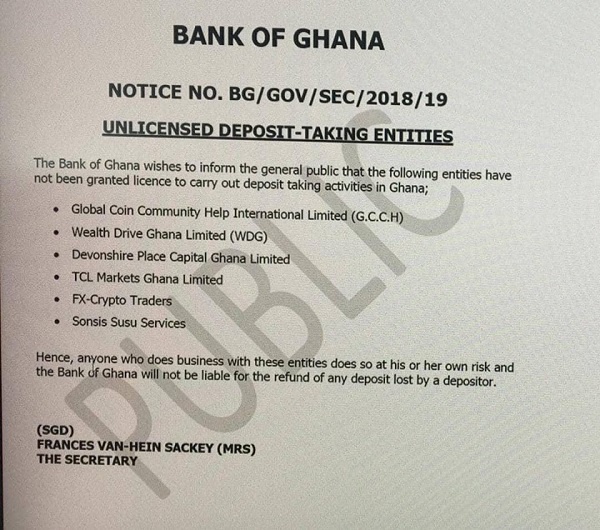

In a latest statement, the Central Bank has warned the public to be wary of the financial institutions they deal with.

The BoG specifically listed six financial institutions that it says are not duly licensed to carry out deposit-taking activities.

“Hence, anyone who does business with these entities does so at his or her own risk and the Bank of Ghana will not be liable for the refund of any deposit lost by the depositor,” the statement added.

Below is the list of the unlicensed financial institutions:

1. Global Coin Community Help International Limited (GCCH)

2. Wealth Drive Ghana Limited (WDG)

3. Devonshire Place Capital Ghana Limited

4. TCL Markets Ghana Limited

5. FX-Crypto Traders

6. Sonsis Susu Services