Mr Emmanuel Kofi Nti, Commissioner General of the Ghana Revenue Authority

Mr Emmanuel Kofi Nti, Commissioner General of the Ghana Revenue Authority

The Ghana Revenue Authority (GRA) has started the implementation of a new VAT regime that empowers some selected companies and institutions in the goods and services sector to withhold seven 7% of the 17.5% VAT on transactions.

Referred to as VAT Withholding Agents, the selected entities will be required to submit the withheld 7% directly to the GRA not later than the 15 days from the day of the transaction.

The new system, which took effect from May 1 is geared towards improving VAT compliance, a notice issued by the GRA said.

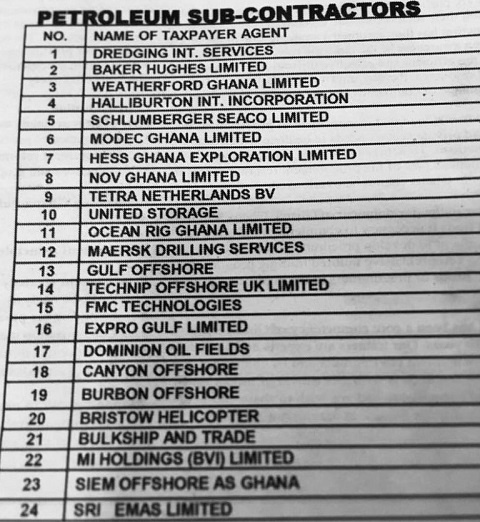

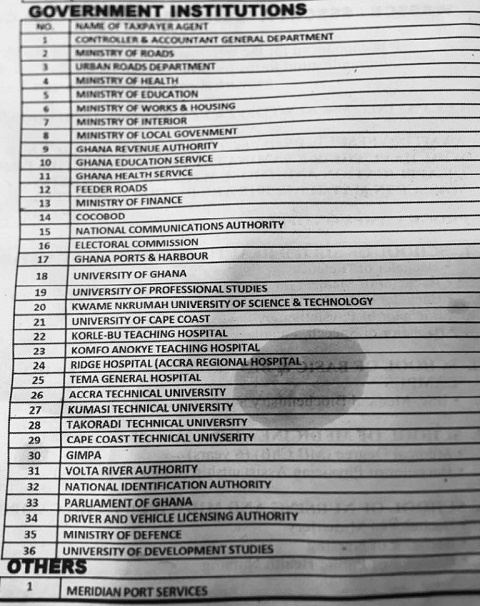

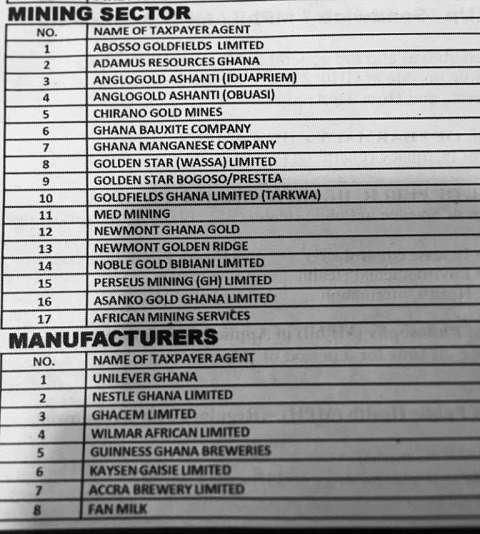

For a start, it announced 118 companies and institutions in the financial, mining, manufacturing, petroleum, telecommunication, and government sectors among others as accredited VAT withholding agents.

“In effect, suppliers of both goods and services to these entities will receive 10.5 of the VAT on their taxable transactions while the entities (Withholding agents) account for 7 directly to GRA. This arrangement applies only to transactions with the appointed VAT withholding agents” it explained.

Meanwhile, the agents will also be able to issue a withholding VAT credit certificate.

The GRA also clarified that suppliers will continue to account for output VAT at 17.5 per cent on all taxable transactions.

They will also “take credit for all allowable input taxes. The input taxes should include VAT withheld by the appointed VAT withholding agents with their VAT withholding certificates issued to them as supporting evidence”.

Below are the agents appointed by the Commissioner general of GRA