Agricultural Development Bank (adb)

Agricultural Development Bank (adb)

The Agricultural Development Bank, Monday, announced the re-opening of its Initial Public Offer (IPO) after attempts by the Union of Commerce, Industry and Finance (UNICOF) to stop it in court failed to materialize.

Following UNICOF's failed attempts to stop the IPO, the bank in a statement released Monday said the Securities and Exchange Commission (SEC), regulator of all firms listed on the Ghana Stock Exchange (GSE), has since given the approval for the re-opening of the IPO.

Below is the full statement:

ADB ANNOUNCES THE RE-OPENING OF ITS INITIAL PUBLIC OFFER ("IPO") Accra, 31st August 2015

The Agricultural Development Bank Limited ("ADB") announces the re-opening of its Initial Public Offer ("IPO") after two applications filed by the Union of Commerce, Industry and Finance ("UNICOF") of TUC at the High Court and the Supreme Court of Ghana for an order of interlocutory injunction were dismissed by the High Court (Industrial and Labour Division II) and struck out as withdrawn by the Supreme Court of Justice of Ghana.

Pursuant to the Writs of Summons filed by UNICOF in the High Court of Justice, Industrial & Labour Division II and the Supreme Court of Justice of Ghana on 7th July 2015 and 30th July 2015 respectively, titled Union of Industry, Commerce & Finance Vrs. Agricultural Development Bank Limited and Union of Industry, Commerce & Finance Vrs. Agricultural Development Bank Limited and Attorney General & Minister of Justice, UNICOF filed successive applications seeking interlocutory injunction restraining the continuation of the ADB IPO.

The High Court of Justice, Industrial & Labour Division II dismissed UNICOF's application on 6 th August 2015 as unmeritorious, while the Supreme Court of Justice of Ghana, upon a voluntary application by UNICOF to withdraw its own application for interlocutory injunction after a review of its legal position, on 19th August 2015, struck out UNICOF's application as withdrawn without liberty to UNICOF to bring similar application in the future.

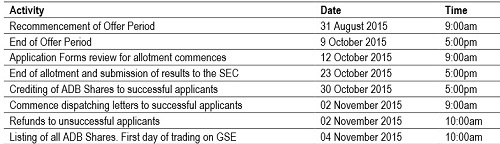

The Securities and Exchange Commission ("SEC") has since approved the re-opening of the ADB IPO and the revised timetable for the IPO is as follows:

First day of trading on GSE 04 November 2015 10:00am Shares can be bought at any ADB branch, any Standard Chartered Bank ("SCB") branch, IC Securities (Ghana) Limited or any Licensed Dealing Member ("LDM") of the Ghana Stock Exchange ("GSE") at GHS 2.65 per share.

Each application under the IPO must be for a minimum of 100 ADB Shares amounting to GHS 265.00 and in multiples of 10 ADB Shares thereafter.

Applicants should however note that there are two Writs of Summons currently pending in the Supreme Court titled: a) Dr. Mark Asibey-Yeboah Vrs. Agricultural Development Bank Limited & Attorney General & Minister of Justice; and b) Union of Industry, Commerce & Finance Vrs. Agricultural Development Bank limited & Attorney General & Minister of Justice.

In the suits, Plaintiffs allege that, because the shares on offer belong to the Government of Ghana and are held in trust for it by the Ministry of Finance, and certain specific aspects of the IPO entail agreements with foreign or international entities, ADB requires prior Parliamentary approval pursuant to Article 181(5) of the 1992 Constitution, in order to engage in the IPO.

Further details on the IPO are contained in the Offer Prospectus which, together with a Supplementary Document detailing the information contained in this press release, can be obtained from any ADB branch, any SCB branch, IC Securities (Ghana) Limited, any LDM of the GSE or www.adbipo.com.

Before deciding whether to apply for the ADB Shares, you should consider whether the ADB Shares are a suitable investment for you. Their value can go up as well as down. Past performance is not necessarily indicative of future performance. If you need advice, you should consult a suitable professional advisor.