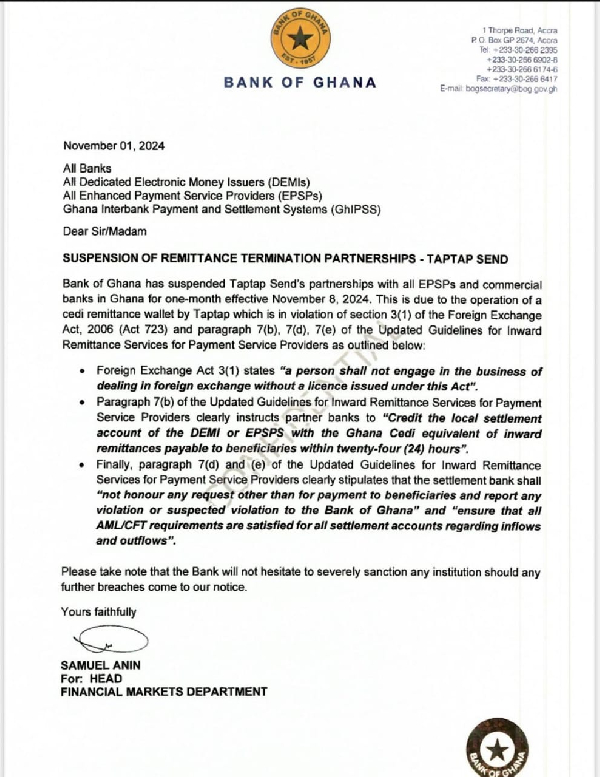

The Bank of Ghana has suspended popular remittance platform, Taptap Send’s partnerships with payment service providers and commercial banks for one month, effective November 8, 2024.

The BoG said this decision follows Taptap Send's operation of a cedi remittance wallet, which goes against the Foreign Exchange Act of 2006 and guidelines for money transfer services.

According to the Bank's statement, Taptap Send violated Section 3(1) of the Foreign Exchange Act, which prohibits engaging in foreign exchange business without a license.

This is due to the operation of a cedi remittance wallet by Taptap which is in violation of section 3(1) of the Foreign Exchange Act, 2006 (Act 723) and paragraph 7(b), 7(d), 7(e) of the Updated Guidelines for Inward Remittance Services for Payment Service Providers as outlined below: Foreign Exchange Act 3(1) states "a person shall not engage in the business of dealing in foreign exchange without a licence issued under this Act," the statement read.

Additionally, Taptap Send did not adhere to the Updated Guidelines for Inward Remittance Services, which require timely crediting of local settlement accounts and strict compliance with anti-money laundering and counter-terrorism financing requirements.

“Paragraph 7(d) and (e) of the Updated Guidelines for Inward Remittance Services for Payment Service Providers clearly stipulates that the settlement bank shall "not honour any request other than for payment to beneficiaries and report any violation or suspected violation to the Bank of Ghana" and "ensure that all AML/CFT requirements are satisfied for all settlement accounts regarding inflows and outflows," the statement added.

The Central Bank emphasised the importance of following these regulations to maintain the integrity of Ghana's financial system and warned that any further violations would result in severe penalties.

See the statement below

ID/MA