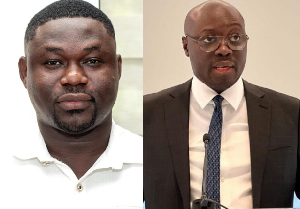

Wisdom Gomashie (L) calls for regulatory framework to safeguard Ghana's minerals

Wisdom Gomashie (L) calls for regulatory framework to safeguard Ghana's minerals

A mining consultant, Ing Wisdom Edem Gomashie, has welcomed the government’s decision to abolish the 15% VAT on mineral reconnaissance and exploration but insists that Ghana must immediately introduce strong regulatory and fiscal safeguards to ensure the country benefits fully from future mineral discoveries.

The Minister of Finance, Dr Cassiel Ato Forson, announced the VAT removal during the presentation of the 2026 Budget Statement and Economic Policy on November 13, 2025, in Parliament.

The reform, which targets reconnaissance and prospecting activities, seeks to revive investor confidence and stimulate greenfield exploration across the country.

In a detailed response to the announcement, Ing Gomashie commended the Ghana Chamber of Mines, resource governance experts and successive governments for building consensus on the policy over the past decade.

VAT Reforms: Government to raise VAT threshold, scrap tax on mineral exploration

“I commend the government for finally removing the VAT on exploration at last,” he noted.

However, the mining consultant warned that simply removing the VAT is not enough to guarantee positive outcomes.

He urged the state to clearly define what constitutes reconnaissance and exploration activities — including geophysics, drilling, assaying and related processes — to prevent abuse and ambiguity.

He further stressed the need for clarity on whether the VAT relief applies strictly to greenfield exploration or includes additional exploration within existing mining operations.

“The state should clearly further define the type of ‘reconnaissance & exploration,’ including whether it only pertains to greenfield activities (which is the obvious case) and excludes further exploration activities of production mines,” he added.

Ing Gomashie also called for a major upgrade of the Monitoring and Evaluation Department of the Minerals Commission to ensure strict compliance with existing laws, especially sections 31–39 of the Minerals and Mining Act, 2006 (Act 703).

According to him, no company should be allowed to hold prospecting licences indefinitely without fulfilling their obligations.

A key part of his recommendations is the need for what he describes as “clawback clauses” — mechanisms that allow the state to recover the value of tax exemptions once a company makes a commercial mineral discovery.

He argued that VAT exemptions represent significant revenue trade-offs that must not be lost entirely when discoveries are made.

Citing a hypothetical example, he explained that if a company spends US$100 million on exploration, the 15% VAT exemption amounts to US$15 million in forgone revenue.

“Ghana cannot simply give this away freely,” he stated, proposing that these forgone taxes could later be converted into additional state carried interest, increased royalties, windfall taxes, citizen equity participation, or reduced capitalisation of expenditures that broaden the country’s taxable base.

He added that effective collaboration between the Minerals Commission, the Ghana Revenue Authority, and the Ghana Geological Survey Authority will be critical in monitoring and enforcing such clawback systems.

Ing Gomashie further recommended that all foreign reconnaissance and prospecting applicants should be required to partner a local Ghanaian entity, with a minimum 30% equity stake.

This, he argued, will strengthen domestic participation in the early stages of mineral development.

For critical minerals and rare earth elements — resources that are increasingly important for global energy transition, digital technology, defence and aerospace — he proposed even stricter measures.

Exploration rights for such minerals, he said, should either be 100% Ghanaian-owned or structured as 50-50 joint ventures with foreign partners.

He cited Canada’s exploration model as a best-practice example where incentives exist alongside mechanisms to recoup state support once a commercial discovery is made.

Ing Wisdom Gomashie further urged policymakers to incorporate these recommendations as they implement the new VAT reforms, emphasising that early-stage exploration incentives must translate into long-term national benefits.

SP/MA

All you need to know about Ghana's new vehicle number plates |BizTech: