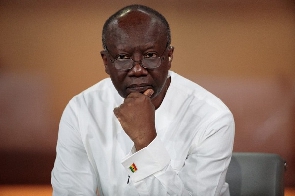

Finance Minister, Ken Ofori-Atta

Finance Minister, Ken Ofori-Atta

Ghana said private foreign creditors may have to accept less favorable terms than bilateral lenders in the country’s $30 billion debt restructuring.

“We hope our commercial creditors will understand our desire to negotiate over bilateral creditors softer terms than we anticipate to propose to them, as a speedy process with the bilateral creditors is needed to pave the way for the discussion with private creditors,” Finance Minister Ken Ofori-Atta told lawmakers in Accra on Thursday.

That’s a setback for eurobond investors who have been clamoring for equal treatment with other lender groups in the restructuring after Ghana said in December it’s stopping payments. But the West African nation is racing against time as it seeks to win concessions from creditors to unlock a $3 billion International Monetary Fund loan by March.

The country has asked for an expedited treatment of its restructuring under the Group of 20’s Common Framework, and reiterated this request during a meeting last month with Paris Club and non-Paris Club creditors, Ofori-Atta said. Ghana aims to start “substantive” discussions with international bondholders and their advisers in coming weeks, he said.

Ghana, which unilaterally suspended payments on eurobonds, commercial term loans and most bilateral debt in December, needs assurances from the investors to show the IMF it is in good standing to bring debt to a sustainable level. It aims to reduce the ratio of debt to gross domestic product to 55% by 2028 from an IMF estimate of 105% of GDP in 2022.

The country sought IMF help in July as it lost access to the international capital markets and investors dumped its eurobonds. The cedi currency tumbled and inflation hovered at 53.6% in January. Gross international reserves declined to $6.2 billion at end-December from $9.7 billion a year earlier, and were enough to cover only 2.7 months of imports, down from 4.3 months in December 2021.

The government just completed the first part of a domestic debt exchange, with investors turning in 83 billion cedi ($6.7 billion) of holdings for new securities, covering 64% of its local debt under reorganization.

Ghana is reorganizing almost $30 billion of eurobonds, local bonds and bilateral loans as part of an overhaul of total public debt that stood at 575.7 billion cedi ($47 billion) as of November. Debt rose after spending pressures from an energy crisis between 2013 and 2015 and a sweeping banking sector cleanup in 2018 were compounded by shocks from the Covid-19 pandemic and Russia’s invasion of Ukraine.

Ghana’s eurobond due January 2026 rose to 41 cents on the dollar Thursday.

Watch the latest edition of BizTech and Biz Headlines below: