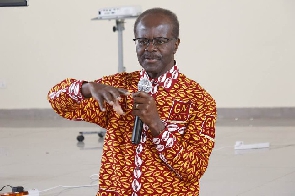

President of Groupe Nduom, Dr Paa Kwesi Nduom

President of Groupe Nduom, Dr Paa Kwesi Nduom

President of Groupe Nduom, Dr Paa Kwesi Nduom, on August 30, 2018, entreated government to desist from using national pension funds to support foreign banks.

According to him, such conduct constitutes a huge disincentive to locally-owned banks.

Paa Kwesi Nduom also said he had evidence “of people who have taken our pension money as pension fund managers, from local investment houses, local banks [and] given them to foreign-owned organisations and banks and investment companies”.

Read the full story originally published on August 31, 2018 by ClassFM.

President of Groupe Nduom, Dr Paa Kwesi Nduom, has called on pension fund managers in the country to stop the use of Ghana's national pension funds to support foreign banks to the detriment of local ones.

According to him, the practice where managers of such funds run to the aid of foreign organisations with local funds at a period the Bank of Ghana (BoG) has pegged the minimum capital requirement at GHC400 million, is a bad one.

Speaking at the launch of UG-GN Re Pensions and Insurance Research Fund in Accra on Thursday, 30 August 2018, Dr Nduom said such conduct constitutes a huge disincentive to locally-owned banks.

“How can those monies be used to support foreign banks and foreign organisations and governments and not local banks, local investment companies and so on?” he questioned.

The business consultant said he has evidence “of people who have taken our pension money as pension fund managers, from local investment houses, local banks [and] given them to foreign-owned organisations and banks and investment companies”.

The former presidential candidate said pension funds have more monies beyond the needs of local banks to meet the minimum capital requirement, and “if special dispensation was given, this same local pension fund money can be used to finance, I’m not talking about what all the local banks need, because you have to review them and look at the ones practising good [corporate] governance who are serious and doing the right things”.

He, therefore, charged the National Pensions Regulatory Authority (NPRA) and other regulatory authorities to re-examine the use of such pension funds which could be the solution to struggling local banks.