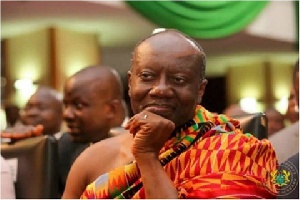

Ken Ofori Atta is Finance Minister

Ken Ofori Atta is Finance Minister

Ghana sold $2 billion worth of dual-tranche Eurobonds in the US on Thursday with 10- and 30-year maturities, government sources said.

The 10-year bond raised $1 billion at an interest rate of 7.627% while the first 30-year bond raised another $1 billion at 8.627% and mature in 2029 and 2049 respectively.

Guidance for the May 2029 bond was set at 7.75 percent to 7.875 percent while the May 2049 was in the 8.75 percent to 8.875 percent bracket.

The notes were first marketed in the low 8 percent area yield and low 9 percent mark.

Total books passed $5.5 billion, evenly split between the two tranches, lead advisers said.

“It’s a marked success for Accra because they got a low yield and a bigger size,” a sovereign debt market watcher told Reuters.

“The pricing revision may have aided the deal and left investors unhappy.”

It was Ghana’s sixth sale since the 2007 debut.

Lead advisers for the sale were Bank of America Merrill Lynch, Citigroup, JP Morgan and Standard Chartered.

Ghana is rated B3/B-/B.

The government has indicated that it plans to use some of the proceeds to refinance debt and up to $750 million as revenue for its 2018 budget.

Ken Ofori Atta, Finance Minister, said the government plans to direct the funds to areas such as irrigation, infrastructure, rehabilitation of warehouses and silos, fisheries and aquaculture inputs, education, road and rail infrastructure.

Analysts have described the deal as a good one.

Most of it is to pay off the previous administration’s debts, principally the $750 million they borrowed less than three months before the 2016 elections.

“The liability management for the tender is about $700 million notional amount, which means that plus the premium, Ghana will pay about $819 million to retire the 2022 bonds and still be left with another $750 million new money to spend for the budget. This makes a total of $1.569 billion, leaving an extra $431 million, which Ghanaians should expect government to take and put in sinking fund and buy back bonds if and when the prices are attractive.”

Comparisons

Commenting on the incumbent administration vis-a-vis the previous one, an economic expert said both bonds issued by the NPP were oversubscribed to over $5.5 billion.

Under the previous, he said Ghana issued a $750m Eurobond for 5yrs payable in 2022 at a rate of 9.25%.

NPP has obtained very favourable rates; and the profile of these bonds is also very favourable. Honestly it is a far cry from the ones we did under the previous government.

“There is a marked improvement in the competency levels with which our economy is being run now, and the international markets are hailing it and voting with their pockets.”