Prof Isaac Boadi, Executive Director of IERPP

Prof Isaac Boadi, Executive Director of IERPP

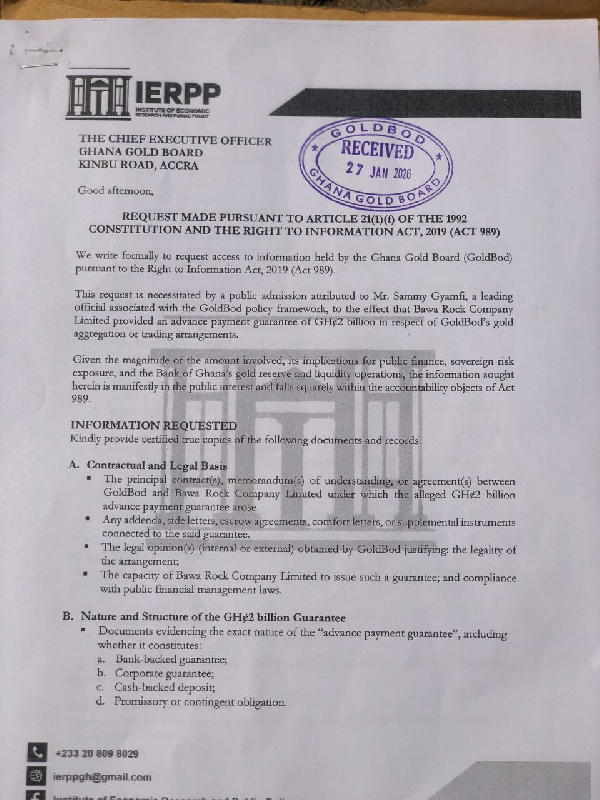

The Institute of Economic Research and Public Policy (IERPP) has formally petitioned the Ghana Gold Board (GoldBod) for full disclosure of documents relating to an alleged GH¢2 billion advance payment guarantee linked to GoldBod’s gold aggregation or trading arrangements.

In a detailed request signed by Prof Isaac Boadi, Executive Director of IERPP, on Tuesday, January 27, 2026, and addressed to the Chief Executive Officer of the Ghana Gold Board and grounded in Article 21(1)(f) of the 1992 Constitution and the Right to Information Act, 2019 (Act 989), IERPP said the request was necessitated by a public admission attributed to Sammy Gyamfi, a leading official associated with the GoldBod policy framework.

“This request is necessitated by a public admission attributed to Sammy Gyamfi to the effect that Bawa Rock Company Limited provided an advance payment guarantee of GH¢2 billion in respect of GoldBod’s gold aggregation or trading arrangements,” the letter stated.

Public finance and sovereign risk concerns

IERPP stressed that the scale of the alleged guarantee raises serious public finance and macroeconomic concerns, particularly for Ghana’s gold reserves and liquidity management.

“Given the magnitude of the amount involved, its implications for public finance, sovereign risk exposure, and the Bank of Ghana’s gold reserve and liquidity operations, the information sought herein is manifestly in the public interest,” the Institute noted.

Five broad categories of information requested

Under the RTI law, IERPP requested certified true copies of documents across five broad areas.

Contractual and legal basis

IERPP is seeking the principal contracts, memoranda of understanding, or agreements between GoldBod and Bawa Rock Company Limited, as well as, “Any addenda, side letters, escrow agreements, comfort letters or supplemental instruments connected to the said guarantee.”

The Institute also demanded disclosure of legal opinions obtained by GoldBod justifying, “the legality of the arrangement; the capacity of Bawa Rock Company Limited to issue such a guarantee; and compliance with public financial management laws.”

Nature and structure of the GH¢2b guarantee

IERPP requested documents evidencing the precise nature of the alleged guarantee, including whether it constitutes a, “bank-backed guarantee, corporate guarantee, cash-backed deposit, [or] promissory or contingent obligation.”

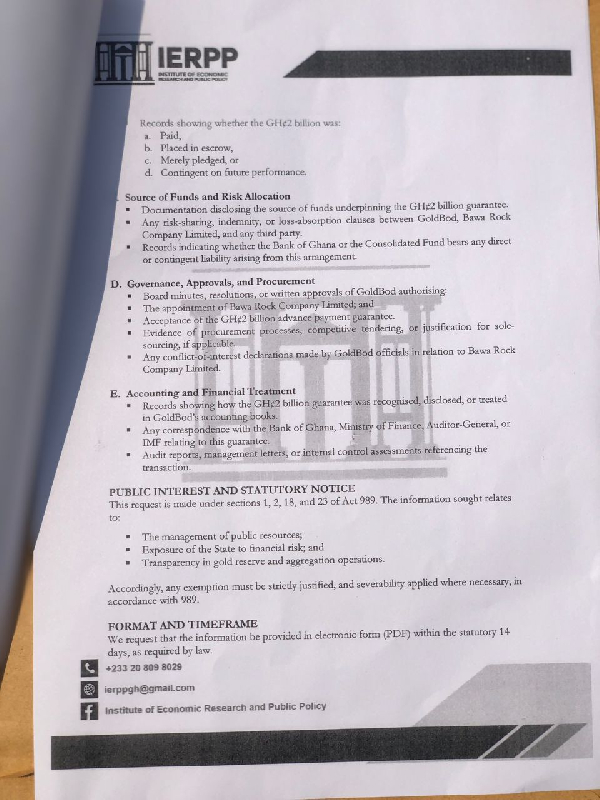

It further requested records showing whether the GH¢2 billion was: “paid, placed in escrow, merely pledged, or contingent on future performance.”

Source of funds and risk allocation

The Institute also demanded clarity on the source of funds underpinning the guarantee and any risk-sharing arrangements.

Among the documents requested are records showing, “whether the Bank of Ghana or the Consolidated Fund bears any direct or contingent liability arising from this arrangement.”

Governance, approvals, and procurement

IERPP asked for board minutes, resolutions or written approvals authorising both the appointment of Bawa Rock Company Limited and acceptance of the alleged guarantee.

It also requested: “Evidence of procurement processes, competitive tendering, or justification for sole sourcing, if applicable,”

as well as any conflict-of-interest declarations made by GoldBod officials.

Accounting and financial treatment

On the financial side, the Institute requested records showing how the guarantee was treated in GoldBod’s books, including:

“Any correspondence with the Bank of Ghana, Ministry of Finance, Auditor-General, or IMF relating to this guarantee and any audit or internal control reports referencing the transaction.

Statutory basis and deadline

IERPP grounded its request in Sections 1, 2, 18, and 23 of Act 989, stressing that the information sought relates to:

“The management of public resources; exposure of the State to financial risk; and transparency in gold reserve and aggregation operations.”

The Institute cautioned that, “Any exemption must be strictly justified, and severability applied where necessary, in accordance with [Act] 989.”

It requested that the information be provided in electronic form (PDF) within the statutory 14-day period and asked GoldBod to acknowledge receipt in writing.

Minority Caucus defends call for Okudzeto Ablakwa's resignation