Support for women in tech still remains low

Support for women in tech still remains low

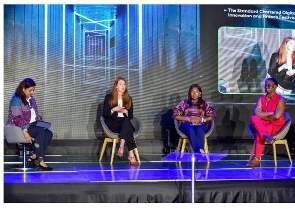

To fully harness the benefits of the digital economy, there is a need for key stakeholders across policy and finance among others to eliminate existing biases and prioritize targeted investment in women-owned businesses. This was the view of a panel of experts speaking on the theme ‘Technology, Gender and Economic Growth: Expanding the role of technology in women-owned business for development,’ at the recently concluded Standard Chartered Digital Banking Innovation and FinTech Festival, where they argued that despite the enormous potential and importance of women-led businesses to economic transformation, their adoption of technology as an enabler remains woefully inadequate. During the session moderated by Standard Chartered’s Regional Head, Corporate Affairs Brand and Marketing, Africa & Middle East, Khadija Hashimi, the shortage of women in key decision-making positions was highlighted as one of the primary reasons women-led businesses receive disproportionately less funding than their male counterparts. Citing a recent study conducted by her outfit which surveyed 2,000 startups over five years, the Director of Special Projects at Village Capital, Rachel Crawford said the phenomenon can be attributed to “who is making decisions and how they are making decisions.” “We will have to do things a little differently, and that would involve putting more women into decsionmaking roles as it relates to who receives financing. It is not that men are unable to do this it is just that traditionally, there might be some subconscious biases that lead to women-led businesses appearing more risky,” she said. Her thoughts are consistent with a number of studies including a Briter Bridges report which showed that even in industries where they are dominant, female founders receive disproportionately less investment than their male counterparts. Between 2013 and 2021, around 1,100 startups raised US$1.7 billion in early-stage funding. All-male founding teams, however, received US$25 for every US$1 that went to all-female founder teams. Furthermore, in contrast to the over 75 percent received by male founder teams, all-female founding teams of the businesses examined garnered fewer than 10 percent of the total capital raised in the edtech sector. Whilst encouraging women to highlight the opportunities their solutions present as opposed to the associated risks they are often asked about, the Chief Executive Officer, Edel Consulting, Ethel D. Cofie, called on financial institutions to build shared technology resources, saying there’ll be benefits accrued from economies of scale and centralised data. “I would like Standard Chartered and related entities to consider building shared technology resources… if you had a shared accounting or fintech platform, it would mean that you are taking some of the cost but that means that they are providing data, so in the event that they come to you for money, you have a sense of who they are and what they are doing and that will give you a competitive edge,” she explained. The rising number of successful women in the tech ecosystem and the success of the usage of tools such as social media in promoting women-led businesses has dispelled the notion that women are technology averse, Co-Founder of Superfluid Labs, Winnifred Kotin, added. Encouraging more investment she said, “Technology has changed the business landscape forever as the competition is now global. Technology should be used as an enabler of growth,” adding that networking at events such as Standard Chartered Digital Banking Innovation and FinTech Festival remains a valuable tool. CEO at Taqwa Invest (UAE), and beneficiary of the Standard Chartered Women in Tech Incubator, Dr. Areeba Khan, called on women to take advantage of all the resources available to them to improve their understanding and application of technology in their businesses. Held in collaboration with SC Ventures (Innovation and Fintech Investment Unit of Standard Chartered), the Fintech Festival is an avenue for important financial services industry players, including FinTechs, to highlight Ghana’s digital infrastructure and the significant advancements the nation has made on the road toward national digitalization.

To fully harness the benefits of the digital economy, there is a need for key stakeholders across policy and finance among others to eliminate existing biases and prioritize targeted investment in women-owned businesses. This was the view of a panel of experts speaking on the theme ‘Technology, Gender and Economic Growth: Expanding the role of technology in women-owned business for development,’ at the recently concluded Standard Chartered Digital Banking Innovation and FinTech Festival, where they argued that despite the enormous potential and importance of women-led businesses to economic transformation, their adoption of technology as an enabler remains woefully inadequate. During the session moderated by Standard Chartered’s Regional Head, Corporate Affairs Brand and Marketing, Africa & Middle East, Khadija Hashimi, the shortage of women in key decision-making positions was highlighted as one of the primary reasons women-led businesses receive disproportionately less funding than their male counterparts. Citing a recent study conducted by her outfit which surveyed 2,000 startups over five years, the Director of Special Projects at Village Capital, Rachel Crawford said the phenomenon can be attributed to “who is making decisions and how they are making decisions.” “We will have to do things a little differently, and that would involve putting more women into decsionmaking roles as it relates to who receives financing. It is not that men are unable to do this it is just that traditionally, there might be some subconscious biases that lead to women-led businesses appearing more risky,” she said. Her thoughts are consistent with a number of studies including a Briter Bridges report which showed that even in industries where they are dominant, female founders receive disproportionately less investment than their male counterparts. Between 2013 and 2021, around 1,100 startups raised US$1.7 billion in early-stage funding. All-male founding teams, however, received US$25 for every US$1 that went to all-female founder teams. Furthermore, in contrast to the over 75 percent received by male founder teams, all-female founding teams of the businesses examined garnered fewer than 10 percent of the total capital raised in the edtech sector. Whilst encouraging women to highlight the opportunities their solutions present as opposed to the associated risks they are often asked about, the Chief Executive Officer, Edel Consulting, Ethel D. Cofie, called on financial institutions to build shared technology resources, saying there’ll be benefits accrued from economies of scale and centralised data. “I would like Standard Chartered and related entities to consider building shared technology resources… if you had a shared accounting or fintech platform, it would mean that you are taking some of the cost but that means that they are providing data, so in the event that they come to you for money, you have a sense of who they are and what they are doing and that will give you a competitive edge,” she explained. The rising number of successful women in the tech ecosystem and the success of the usage of tools such as social media in promoting women-led businesses has dispelled the notion that women are technology averse, Co-Founder of Superfluid Labs, Winnifred Kotin, added. Encouraging more investment she said, “Technology has changed the business landscape forever as the competition is now global. Technology should be used as an enabler of growth,” adding that networking at events such as Standard Chartered Digital Banking Innovation and FinTech Festival remains a valuable tool. CEO at Taqwa Invest (UAE), and beneficiary of the Standard Chartered Women in Tech Incubator, Dr. Areeba Khan, called on women to take advantage of all the resources available to them to improve their understanding and application of technology in their businesses. Held in collaboration with SC Ventures (Innovation and Fintech Investment Unit of Standard Chartered), the Fintech Festival is an avenue for important financial services industry players, including FinTechs, to highlight Ghana’s digital infrastructure and the significant advancements the nation has made on the road toward national digitalization.