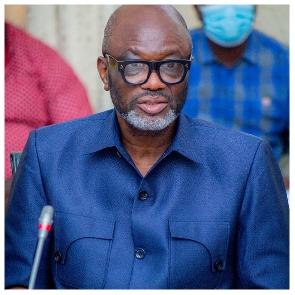

GUTA President, Dr Joseph Obeng

GUTA President, Dr Joseph Obeng

The Ghana Revenue Authority (GRA) has responded to allegations of extortion and harassment levelled by the Ghana Union of Traders (GUTA) and Traders Advocacy Group Ghana (TAGG).

The two groups have alleged frequent arrests of goods by Customs Monitoring Taskforces eventually leading to payment of heavy penalties by traders and the composition of several Taskforces by the GRA with a high tendency of alleged harassment and extortion.

The two trade unions called on the GRA to streamline its systems to bring fairness, parity,

and simplicity.

The groups claimed that the GRA intercepted their cargo in transit from Accra to other regions on allegations of undeclaration of goods.

According to them, after their cargoes had passed through the necessary clearance processes at the port of Tema and were released to them.

The groups added that they will no longer allow GRA officers to harass or intimidate their members by requiring them to bring goods for further examination, provided they have paid the legitimate duty at the port.

The GRA has replied to the allegations mentioned and has denied any form of harassment or extortion.

According to the GRA, it is only conducting its constitutional duty

It stated that they have merely put in place measures to prevent businesses from breaching tax regulations.

It said the Customs Division in particular, has put in place four (4) Monitoring Taskforces to curtail smuggling, under declaration, misdescription and concealment of goods thereby ensuring that the right amount of duties and taxes are paid by importers.”

It has also requested that members of the public report instances of extortion and misconduct.

“We also encourage the general public to report any misconduct on the part of GRA officers during these exercises and in their normal course of work on 0800-900-110. Additionally, the names of companies, importers, and Clearing agents who have been found to be involved in these malpractices and the resultant short collection will be published as the laws prescribe.

GRA will continue to ensure that the human involvement in revenue mobilization is reduced while improving on automation of systems to eliminate the use of discretion and thereby assist taxpayers to comply.

We remain committed to our core mandate of revenue mobilization and facilitation of trade and we assure all traders and the general public that the work of the Taskforces and the other compliance activities is not to intimidate or harass them but rather to ensure that businesses are complying with the tax laws and are paying the right amount of taxes due the Government of Ghana for national development.”