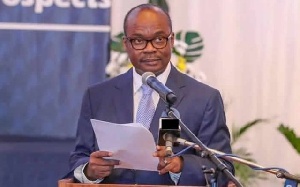

Dr Ernest Addison, BoG Governor

Dr Ernest Addison, BoG Governor

Governor of the Central Bank, Dr. Ernest Addison has disclosed that a very diminutive amount representing less than 10percent of the total loans owed the defunct banks have been retrieved from debtors more than a year since the collapse of the banks, ABC News has gathered.

Dr. Addison explained that a total of GHS 10.1 billion is expected to be received from loan defaulters of these defunct banks. However, out of this large amount, a very small fraction of GHS 849,000 representing less that 10 percent of the total amount has been retrieved. The governor added this amount retrieved does not only accrue from loan repayments but sales of some assets, placements repaid, bonds among others.

The Governor who was speaking at the 17th Working Luncheon of the Ghana Association of Bankers therefore took the opportunity to appeal to the country’s judiciary and other investigative agencies probing these cases to expedite their processes. He contended that their ability to retrieve these funds owed these banks in receivership depends heavily on these institutions probing and trying these named defaulters.

Dr. Addison at the event noted that, “as regulators, we are very grateful for the support received – but urge the investigating bodies and judiciary, government, Chief Justice and security agencies to work steadily on recovering certain assets from shareholders, directors and loan defaulters of the erstwhile defunct banks.”

He added that there are fifty-two cases in various courts of the country, fifty of which have been assigned to specific judges or courts.

“In addition, over sixty cases have been referred to the Special Investigative Team. The task is enormous, but we have confidence in our judicial system to bring those culpable to justice. The Bank of Ghana will continue to work with the Receiver to ensure that bottlenecks in the receivership process are cleared for an orderly winding-down of the defunct banks,” he said.

The Governor noted that Ghana’s financial sector is now in a good and strong condition thanks to the painful but needful financial sector cleanup undertaken under his watch. He maintained that going forward, the Central Bank will not relent on its supervisory role but will maintain strict vigilance of the sector to ensure its growth and stability.

“I have every reason to feel confident about gains and achievements made so far in the financial sector. The financial sector is currently healthier and better able to withstand external shocks compared to the financial sector at the beginning of 2017. It is better capitalized, liquid, profitable and more efficient, and has adequate capital buffers to enable it to manage any adverse external developments. Such an optimistic outlook seemed nearly impossible in 2017 when we started these reforms”, he said.

He continued that dynamic growth-oriented financial system must be strong, well-capitalised, and effectively supervised within a fair regulatory environment in accordance with international best practices and standards.

‘There is therefore a huge regulatory burden on us to remain vigilant toward all forms of risk in the banking sector and to tighten our regulatory and supervisory responsibilities to continue with efforts at strengthening and stabilizing the banking industry,” he said.