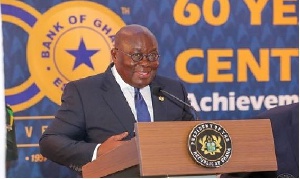

President Nana Addo Dankwa Akufo-Addo

President Nana Addo Dankwa Akufo-Addo

President Nana Addo Dankwa Akufo-Addo has backed the Bank of Ghana (BoG) to forcefully address current challenges in Ghana’s banking sector in order to guarantee the nation’s financial stability and sustained economic growth.

According to him, it was crucial for the BoG to entrench reputation and credibility in the financial system in order to accelerate government’s transformation agenda. “My understanding is that a roadmap for addressing banking sector weakness is being implemented. I urge you, as the nation’s Central Bank, to remain committed to the process and to address the challenges confronting the banking sector. “This will not only guarantee financial stability, but also promote greater confidence in that sector”, President Akufo-Addo said at the opening of BoG’s 60th Anniversary Lectures and Exhibition in Accra last week.

The event, under the theme ‘Celebrating 60 Years of Central Banking in Ghana: Achievements, Challenges and Prospects,’ rounds off activities to mark the Central Bank’s anniversary.

The President lauded the recent measures taken by the BoG in intervening decisively over the matters of UT Bank and Capital Bank.

He said the move was a demonstration of the bank’s preparedness “to act in a manner worthy of a responsible Central Bank and a praiseworthy regulator,” adding: “I am confident that you have the support of the nation.” This show of support and confidence from the President comes in the wake of criticism from some analysts and bank customers of the regulator’s handling of the collapse of the two banks. The swift intervention of the BoG elicited some panic from customers as many besieged some of the premises of the two banks across the country. “I don’t like GCB Bank, that’s why I left so I’m going to close my account,” one customer said.

President Akufo-Addo stressed the need for a stronger partnership between the government and the BoG to enable the bank to play a pivotal role in formulating and implementing policies that would assure the economic transformation of the nation.

“I want to stress that the current socio-economic challenges of our beloved Ghana demand that every hand should be on deck. I wish to reiterate my call for stronger partnership, as well as greater degree of policy co-ordination, between the Bank of Ghana, and the Ministry of Finance. “This call is for the bank, within its remit of operational independence, to play a pivotal role in formulating and implementing policies that will enable the economic transformation of our nation that we all desire,” he said.

President Akufo-Addo noted that the bank had remained at the forefront in developing and deepening the financial market in Ghana, and that it was of utmost importance for it to continue to fulfill that role and address all challenges.

He said the burden of maintaining stability was not that of the Central Bank alone, but government had a role to play.

“We are committed to the path of fiscal consolidation. We must do this so that the Bank of Ghana can concentrate on what it was set up to do. Persistent and excessive fiscal deficits get in the way of the bank’s core mandate,” he said.

The President stressed government’s commitment to ensuring that Ghana’s overall fiscal deficit remained within a reasonable range of between three and five per cent, beginning from 2018.

He said government was also working assiduously to offset the huge energy sector-related debt that threatened the stability of the country’s banking system.