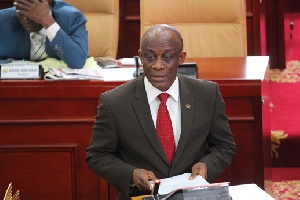

Seth Terpker, former finance minister

Seth Terpker, former finance minister

Former Finance Minister, Seth Terkper, has called for a debt sustainability programme to restructure the country’s debt.

This program he said could be either an external or internal program.

Ghana’s total public debt stock reached an all-time high of GH¢291.6 billion in December 2020, approximately 76.1% of GDP, the Bank of Ghana said.

Addressing participants at the maiden PFM Tax Dialogue Series on the fiscal economy, Mr Terkper said a restructuring program is needed to streamline the country’s debt.

This he believes when done can save the country from borrowing to repay existing debt as well as finance recurrent expenditure.

“The qualification is that if you do not go into a programme to restructure your debt to maybe lengthen it, to reduce the stress and whatever you have to pay interest, it means you have to borrow because the consequences of not doing so is to default.

“And if you default as a nation it’s very disastrous; so nations don’t like to default. So there are those you can hardly do anything about, but there are some like public sector workers wages which you can do something about”, he pointed out.

He added that tax reforms are critical in generating more revenue instead of the policy of upward tax adjustment.

“We need a revenue modernization – very comprehensive one – and there were a number of tax reforms that were embarked upon…you remember 2009, we settled the question by creating GRA [Ghana Revenue Authority] to replace RAGB [Revenue Agency Governing Board] and then we merged IRS [Internal Revenue Service] and VAT Service into the Domestic Tax Division”.

Almost 50% of tax revenue generated in Ghana is used to settle interest payments, whilst wages and salaries also consume a sizeable amount, leaving little space for financing capital and infrastructural projects.

The former Finance Minister also proposed a comprehensive revenue modernization if the country is to mobilize enough revenue to finance its projects as well as pay salaries and interest payments.

Presently, the nation’s tax revenue to Gross Domestic Product is about 13%, below the Sub-Sahara Africa average of 15%.