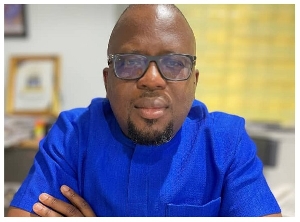

Dela Herman Agbo, Chief Executive Officer of EcoCapital Investment Management Ltd.

Dela Herman Agbo, Chief Executive Officer of EcoCapital Investment Management Ltd.

Today, our attention is directed towards the significance of investment guidelines within the framework of the investment management process. This particular subject has been chosen due to the prevalent absence of investment guidelines among numerous investors in Ghana and the surrounding region.

Investment guidelines, alternatively referred to as Investment Policy Statements (IPS), represent formal documents discussing the parameters, objectives, constraints, and guidelines governing the management of an investment portfolio. Serving as a structured framework, these guidelines facilitate the process of making investment decisions and managing portfolio assets in accordance with the investor's objectives, risk tolerance, and preferences. Below are several reasons highlighting the significance of having investment guidelines in collaboration with your fund manager:

✓ Clarity and Consistency: Investment guidelines provide clarity and consistency in the management of investment portfolios by defining the objectives, constraints, and parameters within which the fund manager operates. By clearly articulating the investor's goals, risk tolerance, time horizon, liquidity needs, and other preferences, investment guidelines help ensure that investment decisions are aligned with the investor's overall financial objectives and expectations.

✓ Risk Management: Investment guidelines help manage investment risk by establishing limits, restrictions, and guidelines on portfolio composition, asset allocation, risk exposure, and other factors. By defining acceptable levels of risk and specifying constraints on certain types of investments or concentrations, investment guidelines help mitigate potential risks and safeguard the investor's capital against adverse market conditions or unexpected events.

✓ Asset Allocation: Investment guidelines guide asset allocation decisions by setting targets, ranges, or benchmarks for the allocation of portfolio assets across different asset classes, sectors, regions, and investment strategies. By providing a strategic framework for asset allocation, investment guidelines ensure that portfolio diversification is aligned with the investor's risk-return profile and long-term investment objectives.

✓ Investment Selection: Investment guidelines define the criteria and guidelines for selecting specific investments, securities, or financial products that are consistent with the investor's preferences and constraints. By specifying acceptable types of investments, credit quality standards, liquidity requirements, and other criteria, investment guidelines help guide the fund manager's investment selection process and ensure that investment decisions are made in accordance with the investor's preferences and risk parameters.

✓ Performance Monitoring and Reporting: Investment guidelines serve as a basis for monitoring and evaluating investment performance by establishing benchmarks, targets, and criteria against which investment outcomes are assessed. By comparing actual investment results against the specified guidelines and objectives, investors can evaluate the effectiveness of the fund manager's investment strategy, track progress towards achieving financial goals, and make informed decisions about portfolio adjustments or rebalancing as needed.

✓ Compliance and Accountability: Investment guidelines help ensure compliance with legal, regulatory, and fiduciary requirements governing the management of investment portfolios. By establishing guidelines for ethical conduct, conflicts of interest, disclosure, and transparency, investment guidelines promote accountability, integrity, and trust between the investor and the fund manager.

In summary, given the gravity of investment endeavors, the implementation of investment guidelines emerges as very important. These guidelines serve as indispensable tools, offering clarity, consistency, risk management, asset allocation strategies, investment selection criteria, performance monitoring frameworks, regulatory compliance protocols, and mechanisms for ensuring accountability in the management of investment portfolios.

By establishing clear guidelines and parameters for portfolio management, investors can align their investment strategies with their financial goals, preferences, and risk tolerance, enhancing the likelihood of achieving long-term investment success.

For a deeper understanding of this subject and further assistance kindly contact EcoCapital Investment Management Ltd., on +233(0)501 553 502 or send us a mail via invest@ecocapinvestment.com.