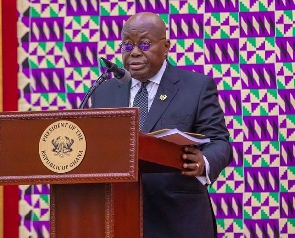

President of Ghana, Nana Addo Dankwa Akufo-Addo

President of Ghana, Nana Addo Dankwa Akufo-Addo

President Nana Addo Dankwa Akufo-Addo on May 3, 2022, said the introduction of E-Levy was to fill in the country's revenue losses.

His comment cleared the air on the controversies that surrounded the introduction of E-Levy.

“These measures, such as the passage of the E-Levy Bill, have not been introduced in isolation. They have come on the back of a revenue loss of GH¢13.1 billion, and an increased, unbudgeted expenditure of GH¢14.2 billion. There is, thus, an overall fiscal impact of some GH¢27.3 billion, representing 6.8% of GDP," President Akufo-Addo said.

Read the full story originally published on May 3, 2022, by StarrFM.

President Nana Addo Dankwa Akufo-Addo has said government had to initiate the controversial Electronic Transfer Levy (E-Levy) for a quick economic recovery from the effects of the COVID-19 pandemic.

“These measures, such as the passage of the E-Levy Bill, have not been introduced in isolation. They have come on the back of a revenue loss of GH¢13.1 billion, and an increased, unbudgeted expenditure of GH¢14.2 billion. There is, thus, an overall fiscal impact of some GH¢27.3 billion, representing 6.8% of GDP," he said.

"We, thus, have to make concerted efforts as Partners to hasten our recovery from COVID-19 by finding intelligent ways of bringing everyone on board to contribute their quota, no matter how small,” President Akufo-Addo said in his Workers’ Day celebration message on Sunday.

He continued that, “In addition to this, adverse global developments have impacted severely on exchange rate and inflation, with the overall effect being the weakening of the real incomes of people in Ghana, just as is happening everywhere. That is why the Secretary-General can justifiably list the litany of woes that are adversely affecting the living standards of working people in Ghana and in the outside world – high inflation, high fuel and petroleum prices, escalating food prices, and reduced income levels.”

President Akufo-Addo also explained that “Indeed, we have had to cut discretionary expenditures of Ministries, Departments and Agencies by thirty percent (30%), we have reduced the salaries of political appointees by thirty percent (30%) for the rest of the year, reduced their fuel coupon allocation by fifty percent (50%), and placed a moratorium on the purchase of imported vehicles, amongst others.”

Background

The controversial electronic transaction levy which has got many Ghanaians talking on mainstream and social media since it started on Sunday May 1, 2022.

The new tax will see the deduction of 1.5% of the cost of selected electronic transactions by Ghanaians.

Many Ghanaians have taking to Twitter and Facebook to vent their disapproval of the move which has been justified by government.

Meanwhile, the Ghana Revenue Authority (GRA) says it is ready for the take off of the controversial levy.

In a statement, the GRA said, “The Authority assures the general public that adequate measures have been put in place to ensure the smooth implementation of the Levy”.

The statement added: “GRA has held several technical sessions and engagements with the various charging entities (Electronic Money Issuers, Banks, Payment Service Providers, and Specialised Deposit-taking Institutions) on the implementation of the E-Levy, with the aim of ensuring that the charging entities are in a position to implement the Levy by the due date”.