Liquidity on Ghana Fixed Income Market remains thin on the back of lingering uncertainties

Liquidity on Ghana Fixed Income Market remains thin on the back of lingering uncertainties

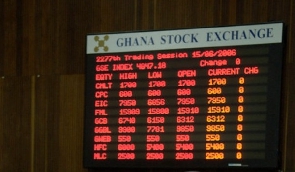

Liquidity on the Ghana Fixed Income Market (GFIM) remains thin on the back of lingering uncertainties over the Domestic Debt Exchange Programme (DDEP).

Government has ended the domestic debt exchange programme but there remains uncertainty over whether the 80 percent participation target will be met due to resistance from individual investors, as reaching the threshold remains paramount to a final agreement with the International Monetary Fund (IMF).

As a result of the uncertainty, market data indicate trading volumes tumbled by 12 percent week on week (w/w) to GH¢932million. In volume terms, about 139 million Government of Ghana (GoG) notes and bonds as well as corporate bonds were traded.

Similarly, in the month of January 2023, the fixed-income market total volume traded declined to 10.09 billion, which is valued at GH¢8.83billion from the 11.40 billion traded the previous month and a further drop of 39.86 percent compared to the 16.68 billion volumes traded in January 2022 valued at GH¢16.84billion.

According to Apakan Securities, a market watcher, the 3-year and the 6-year bonds were mostly traded. The Jan-2025 bond at a coupon rate of 21 percent was actively traded and cleared at 55 percent, while the October-2024 bond at a coupon rate of 21 percent was priced at 53 percent.

During last week’s trading session GH¢2.25billion in volume of GoG bonds, notes and bills were traded, reflecting 16.56 percent more market action than the previous week’s GH¢1.93billion. The corporate bond market also recorded GH¢113.73million in volume traded.

Meanwhile, Fincap Securities – another market watcher – highlighted in its review of the market that the front-end of the yield curve saw relatively active bids as few risk-tolerant investors maintained an appetite for the short-dated papers.

“The front-end of the curve was relatively actively bid as few risk-tolerant investors maintained an appetite for the short-dated papers. Treasury-bills recorded the most patronage for the fifth week running, accounting for 62.09 percent of the market share. The tail-end and midsection of the investment spectrum-maintained silence over the week,” Fincap Securities said.

The market watcher also noted that Treasury-bills maintained their status as the “go-to” government debt instrument for the majority of financial market players owing to their exemption from the DDEP.

The Treasury at last week’s auction exceeded its GH¢1.42billion fundraising target by 37.30 percent to raise GH¢1.95bn. Its target for this week’s auction is at GH¢2.76billion.

Amended terms for DDEP

In December 2022, government invited all holders of Ghana’s Bonds to volunteer an exchange of their holdings for New Bonds whose terms were compatible with its desired downward debt trajectory – within the context that for Ghana to reach the required debt sustainability threshold of debt-to-GDP of 55 percent, it was important to review the interest rates and maturities of the existing bonds.

However, there were emerging concerns about the nature of the debt operation from bondholders, forcing government to recalibrate the DDEP’s framework.

The debt exchange programme’s updated memorandum reclassified eligible bondholders into three categories with different terms for each category. Category A bondholders include all investment schemes such as mutual funds or unit trusts, and all individual bondholders below the age of 59. Investors in this category are eligible to hold two bonds which will mature in 2027 and 2028, with principals in a ratio of 50:50 ratio and 10 percent interest per year.

Category B bondholders include all individual bondholders aged 59 or older. Category B holders have similar terms as Category A; however, they will receive 15 percent interest per year.

The last group is the General Category bondholders. These are bondholders that are neither Category A or Category B bondholders. These bondholders will still tender their old bonds for 12 new bonds as per the previous terms, but with a slight change in the interest payment structure.

On the back of these recent developments – the comprehensive agreement with key stakeholders and enhancement of the DDEP – government expects the full participation of institutional stakeholders and mobilisation of all qualified investors to ensure success for the debt exchange operation.