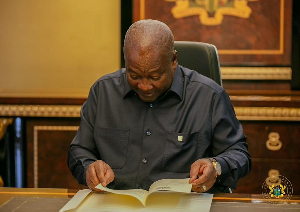

President Mahama has signed the bill into law to regulate crypto | File Photo

President Mahama has signed the bill into law to regulate crypto | File Photo

There is a new law in place, as President John Dramani Mahama has signed the Virtual Asset Service Providers (VASP) bill into law.

This formal exercise ushers in Ghana’s regulated virtual assets ecosystem and marking a significant milestone in the country’s financial sector development.

The Deputy Director-General of the Securities and Exchange Commission, Mensah Thompson, announced this via a post on Facebook, indicating that it follows the passage of the bill by Parliament after an extensive consideration process.

The new law provides a legal framework for the use, trading and provision of services related to virtual assets, including cryptocurrencies, effectively bringing activities in the digital assets space under regulatory oversight.

With the law now in force, the Securities and Exchange Commission and the Bank of Ghana are expected to play central roles in supervising and regulating virtual asset service providers, a move aimed at strengthening investor protection, market integrity and financial stability.

In the post, Mensah Thompson wrote that; “The Bill among other things legalizes the usage, trading and provision of service in the virtual assets (including cryptocurrencies) space. The SEC and the Bank of Ghana wishes to congratulate His Excellency the President, The Minister for Finance, the Governor of the Central Bank and the Director General of the SEC for their foresight in moving Ghana an inch closer towards the next phase of global finance and inclusion.

“Special thanks to VASP market operators including the big exchanges and traders who made immense contributions towards the bill and most important to the Chairman of the Finance Committee of Parliament the Hon Isaac Adongo for his enormous directions and support through out the legislation process.”

The statement acknowledged the role of key stakeholders, including the Presidency, the Ministry of Finance, the Bank of Ghana, Parliament and industry operators, in advancing the legislation.

It also highlighted the bipartisan support the bill received in Parliament and the technical contributions from staff of the SEC and the central bank.

The enactment of the VASP law is seen as part of Ghana’s broader efforts to align its financial system with global trends in digital finance, promote innovation and expand financial inclusion within a clear and robust regulatory framework.

AE