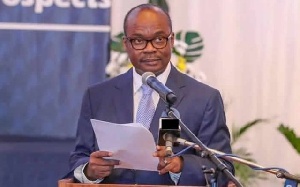

Ernest Addison, Governor of the Bank of Ghana

Ernest Addison, Governor of the Bank of Ghana

The International Monetary Fund has given Ghana a pat on the back for undertaking the banking sector reforms which posed serious threats to Ghana’s economy and development, ABC News can report.

Abebe Aemro Selassie, Director of the African Department at the IMF indicated that Ghana would have paid a huge prize for failing to correct the deficiencies in the banking sector.

Ghana, as part of the banking sector reforms, increased the minimum capital requirement from GH¢120 million to GH¢400 million which came into effect on December 31, 2018.

The country spent about GHC14 billion of unbudgeted funds to clean up the banking sector which resulted in the collapse of hundreds of microfinance and 23 savings and loan companies and some universal banks.

UniBank Ghana Ltd, UT Bank, Capital Bank, Royal Bank, Construction Bank, Beige Bank, and Heritage Bank, were among some casualties at the end of the exercise. The cost raised some eyebrows as some analysts and government critics have suggested that the government could have dealt with the situation differently and spared the taxpayer such a huge amount, saved the jobs of over 20, 000 people that were lost

But Abebe Aemro Selassie argued, “The alternative to not cleaning up the banking sector is even a bigger cost to the budget and to the economy as this can cause a disruption,” ABC News can report.

“We have seen what failings have done to the global economy and you don’t want that in your country.

“Let’s avoid the kind of damage that banks failing, banks and financial sectors failing, can have globally.

“We just have to look back to the global financial crisis and the turmoil it’s caused in countries such as the United States and many European countries,” he said in response to questions posed by a Daily Graphic journalist.

Addressing the press as part of the ongoing IMF/World Bank Annual Meetings in Washington DC, in the United States, the Director of the African Department at the IMF, however, advised the Central Bank not to sleep on their supervisory roles as was done in time past.

This he noted will avoid Ghana getting into a similar position they found themselves that required urgent measures like the banking sector cleanup in the future.

“The central lesson here and a real important takeaway is a real-time regulation to make sure banks are adhering to all the requirements to practice safe banking,” he said.

“Financial sectors are deepening, the importance of upgrading banking supervision, banking regulation is going to be really important to avoid the risk of the banking sector collapse,” the Director of the African Department at the IMF remarked, ABC News can report.

The Bank of Ghana has insisted that all persons that were involved, in any way, to the crisis faced by the banking sector and the financial institutions, will be prosecuted.