The account is designed to drive behavioural change towards savings, micro-insurance and credit

The account is designed to drive behavioural change towards savings, micro-insurance and credit

In line with its commitment to financial inclusion, Access Bank Ghana has introduced an innovative savings product known as – “LIVE B3TA”, targeted at women groups in rural and peri-urban areas with limited access to financial services.

The “LIVE B3TA” savings account forms part of the unique solutions offered by Access Bank’s flagship women empowerment programme, “W” Initiative. It is supported by Savings at the Frontier (SatF), a joint programme by Mastercard Foundation and Oxford Policy Management Ltd (OPM), which is aimed at improving the financial inclusion of low-income individuals and communities in sub-Saharan Africa.

The account is designed to drive behavioural change towards savings, micro-insurance and credit. It is an insurance-embedded group savings account integrated with mobile money, and makes it easier for customers to do their banking anywhere and at any time. For ease of reference, customers can also use their phone numbers as account numbers.

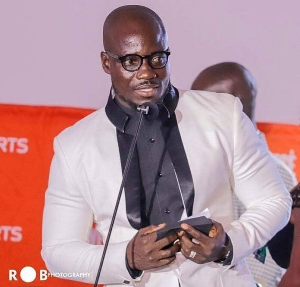

Speaking on the strategic partnership, the Managing Director of Access Bank Ghana, Olumide Olatunji mentioned that the support from SatF will further boost the Bank’s drive towards helping more women become financially independent and empowered through financial literacy training.

He mentioned that the partnership with SatF further underscores Access Bank’s commitment to becoming a major contributor of Ghana’s economic advancement through research backed financial inclusion strategies.

“We are receiving support of up to US$1,000,000 from SatF and this is critical in providing the right systems and resources to ensure that the journey we began in 2015 to improve the financial independence of every woman in Ghana is achieved much earlier than we anticipated”.

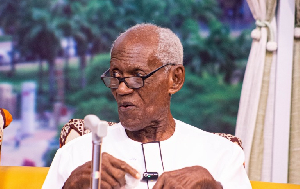

Speaking on behalf of SatF, Team Leader Sukhwinder Arora said: “The problems facing informal savers, particularly women, in accessing suitable savings products are well known – yet up until now, the ability of formal financial institutions to reach them have proved difficult. We are delighted to be working with Access Bank in their quest to provide new banking opportunities for thousands of rural and peri-urban savers across Ghana and in the process demonstrate that both the Bank and women savers can benefit”.

The “W” Initiative packages multiple banking products and services into all-in-one bundles that appeal to women either as young professionals, homebuilders or entrepreneurs. Many women across Ghana are currently benefiting from this unique initiative which seeks to inspire, connect and empower women through the various stages of their lives.