Casseil Ato Forson, MP, Deputy Minister of Finance

Casseil Ato Forson, MP, Deputy Minister of Finance

By Casseil Ato Forson, MP, Deputy Minister of Finance

Abstract

The paper estimates the Total Cost of major NPP Promises in their manifesto and assesses the Party’s proposed tax cuts on economic growth and revenue generation to finance the cost of the promises. The relationship is robust even after controlling for economic growth.

The paper finds a negative and elastic relationship between corporate tax rate and economic growth with an elasticity of about 3.17, suggesting that a 1% reduction in corporate tax rate will increase economic growth by 3.17% at the margin.

The paper also finds a positive, significant but inelastic relationship between real GDP growth and real tax revenue with an elasticity of 0.2, suggesting that a 1% increase in real GDP would increase real tax revenue by 0.2% at the margin. Deducing from the two results, a 1% reduction in corporate tax rate would cause about a 3.2% increase in economic growth at the margin which would further increase real tax revenue by 0.64% (i.e. 0.2% x 3.2%) at the margin.

Hence the increase in tax revenue resulting from the stimulation of the economy would not be enough to compensate for the loss in tax revenue resulting from the tax cuts. Hence the proposed strategy of reducing corporate tax to stimulate economic growth and relying on the ensuing tax revenue increase from the growth stimulus to finance the proposed promises is very far-fetched.

The paper concludes, therefore, that given the rigid nature of budget allocations due to the statutory expenditures in the budget, the expenditures associated with the promises could only be financed through deficit financing ,and therefore a significant increase in debt which will render public debt unsustainable.

Introduction

Tax revenue is very critical for every economy. Yet, the impact of taxation on growth and investment has remained a hotly debated issue, not only to the academics but to politicians and policy makers as well. Proponents of tax cuts argue that lower taxes would both stimulate the economy in the short run and increase normal output in the long run through their positive effects on incentives to work, spend, save, and invest.

To them, higher taxes hurt the economy by distorting behaviour – reducing work effort, spending, saving, and risk-taking. For example, Romer and Romer (2014), investigated the impact of tax changes on economic activity in the postwar United States (1950-2007). They found that an exogenous tax increase of 1 percent of GDP lowers real GDP by roughly 2 to 3 percent.

In many poor developing countries, a low tax-revenue relative to GDP prevents them from undertaking ambitious development expenditure programs. Furthermore, due to the inefficient tax administration systems in these countries, tax rates tend to be high and concentrated on few tax payers and on indirect taxes. Mobilizing additional resources through new tax regimes, external financial support, and deficit financing to finance budgetary expenditures is therefore a policy priority.

Ghana has pursued major tax reforms over the last two decades. The country moved progressively from a historically high corporate tax rate regime of 65 percent in the 1980s to 32 percent in 2001 and 25 percent in 2006. In 2006, when the corporate tax rate fell to 25 percent, corporate income tax revenue dropped by 3.1 percent while real GDP growth rose by 0.3 percent, (up from 5.9 percent in 2005 to 6.2 percent in 2006) before falling by 1.9 percent in 2007, (down from 6.2 percent in 2006 to 4.3 percent in 2007).

Non-oil tax revenue increased from GHS4.2 billion in 2008 to GHS23.7 billion in 2015, representing an increase of 461.6 percent in nominal terms and 137.3 percent increase in real terms. Tax Revenue as a percentage of GDP also increased from 14.0% in 2008 to about 17.0% in 2015.

Ghana’s tax system, especially the corporate income tax regime compares favorably with its peers in the lower middle-income bracket—the average corporate income tax rate for LMIC is 29.6% compared to Ghana’s 25%.

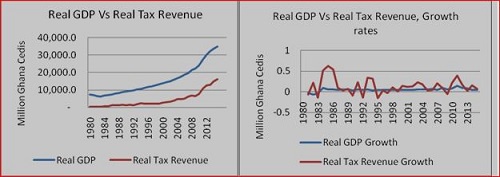

The movement of real GDP and real tax revenue has always been positive, with growth rate higher than the growth in real tax revenue. This explains the fact that the growth rate in real GDP is not strong enough to pull up the growth rate in real tax revenue.

Figure 1: Trends in Various Economic Indicators: 1980 - 2015

The NPP argue that Ghana has a very high tax regime and that a further reduction in corporate income tax rate and abolition of other indirect taxes could generate substantial benefits to the country. In this spirit, the New Patriotic Party’s (NPP) as stated in its 2016 Manifesto, promises to reduce corporate income tax rate from the current 25 percent to 20 percent and also abolish a host of other indirect taxes, including the following, when it wins the power to govern.

(i) removing import duties on raw materials and machinery for production within the context of the ECOWAS Common External Tariff (CET) Protocol;

(ii) abolishing the Special Import Levy;

(iii) abolishing the 17.5% VAT on imported medicines not produced in the country;

(iv) abolishing the 17.5% VAT on Financial Services;

(v) abolishing the 5% VAT on Real Estate sales,

(vi) abolishing the 17.5% VAT on domestic airline tickets; and

(vii) Reducing VAT for micro and small enterprises from the current 17.5% to 3% Flat Rate VAT

Furthermore, the NPP proposes to pursue some very ambitious development projects. For the purpose of this paper we highlight just four (4) of these projects, namely:

(i) one-district-one factory;

(ii) one-village-one-dam in the northern regions;

(iii) one-million dollars-per-one-district per year; and

(iv) one-extension officer per 500 farmers.

The intent is to stimulate economic growth through tax cuts with the resultant higher output also spurring higher tax revenue. On top of the proposed tax cuts, the NPP hopes to create fiscal space to support the financing of the expenditures by: broadening the tax base through the formalization of the economy;

(i) enforcing tax compliance;

(ii) reducing government expenditure through increased collaboration with the private sector and prioritization of government expenditure;

(iii) reallocating savings from the reduction of interest paid on the country’s debt stock;

(iv) increasing oil and gas revenues from TEN and SANKOFA fields;

(v) eliminating corruption, especially in the procurement of goods and services, estimated at about 1.5% of GDP annually; and

(vi) plugging the leakages in the administration of public finances.

The general perception is that, some of these policies are not only shambolic and vague but their revenue impact cannot be quantified. Besides, many of them are not new as the current NDC government is already implementing a number of tax administration reforms, including, broadening the tax base, enforcing tax compliance, and plugging revenue leakages. The NPP admits that the NDC government has been able to mobilize unprecedented amount of resources in taxes and loans over the past eight years, which was estimated at GHS486 billion (NPP Manifesto, 2016).

Available figures from various budget statements show that nominal tax revenue plus borrowing amounted to GHS179.9 billion cumulatively over the period 2009-2015 compared with GHS20.6 billion over the period 2001-2008. Taking the 2016 revised budget estimates into account, this would amount to GHS216.7 billion in eight years contrary to the NPPs claim that the NDC government have mobilized an unprecedented resources in taxes and loans of up to GHC486 billion over the period 2009-2016. This remarkable performance in revenue mobilization could be largely attributed to improvements in tax administration.

Thus, if the efficiency gains from the measures being proposed by the NPP have been largely reflected in tax revenue already, then repeating them will make only limited impact on tax revenue.

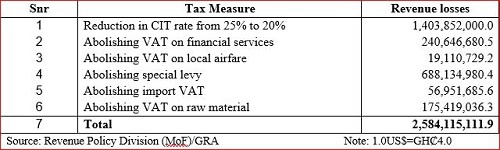

1. How much does it cost to implement NPP’s proposed policies To make any meaningful analysis of these policies, it is important to know how much they will cost. Estimating the cost of some of the policies is quite straight forward. Our preliminary estimates show that the proposed reduction in corporate tax rate alone will result in a revenue loss of approximately GHS1.4 billion as shown in Table 1. Abolishing VAT on financial services will incur a revenue loss of GHS240.6 million. Abolishing the special levy will result in a revenue loss of GHS688.1 million while abolishing VAT on raw materials will lead to a revenue loss of GHS175.4 million. Table 1 show that six out of the seven proposed tax cuts will result in an estimated revenue loss of roughly GHS2.6 billion in 2017 alone.

Table 1: Projected Revenue Loss from Proposed Tax Cuts (Ghana Cedis)

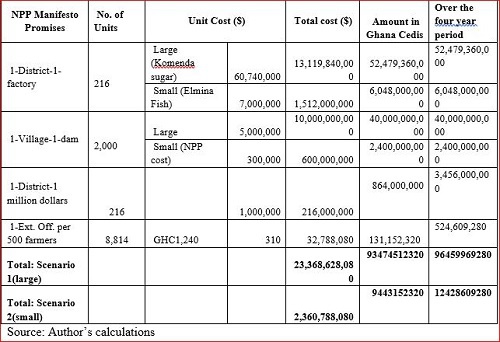

Now let’s look at the development projects. As mentioned earlier, we select only four of those projects for the purpose of this paper. Let’s start with the one-village-one-dam policy. The NPP’s unofficial projection is to construct at least 2,000 dams at a unit cost of $300,000 (myjoyonline, 2016).

This brings the total cost of this project to roughly US$600,000,000 and using an exchange rate of US$1 to GHS4, this will amount to GHS2.4 billion as shown in Table 2. With regards to the one-district-one-factory policy, available evidence suggests that a factory, depending on the type and size, will cost a minimum of US$7.0 million. Implementing this across the 216 districts will require a budget of at least US$1.5 billion, which is equivalent to GHS6.0 billion.

Assuming that the one-million dollars per one district policy is to be implemented separately from the above policies, this will give us a straight figure of US$216 million or GHS864 million per year.

Table 2: Estimated Cost of Proposed NPP’s Selected Projects

According to the sixth Ghana Living Standards Survey (GLSS 6), about 51 percent of Ghanaian households are engaged in farming and about 44.7 percent of economically active Ghanaians are engaged in agriculture. Given the total labour force of 11,940,000 (2014 est.), the labour force participation rate of 79.6 percent, and using a conservative agriculture labour force growth rate of 1.23 percent, the total farmers population is estimated to reach about 4.4 million by 2017.

Assigning one extension officer per 500 farmers will therefore, require at least 8,800 extension officers. At an entry salary level of GHS1,200, this policy will cost at least GHS131.2 million per annum. Thus, using the least cost scenario, it appears that the four policies alone will cost the government roughly GHS9.4 billion in one fiscal year, which translate into 12.4billion over the four-year period.

Of course, some of them are one-time expenditures and are likely to be staggered over the 4-year political cycle or more—the dam and the factory belong to this category. At the extreme, we are talking about roughly GHS93 billion for these four projects alone per year, which translate to GHS96 for the four year period.

The recurrent component of the four projects alone, namely, the one-million dollars-per-one-district per year and one-extension officer per 500 farmers, however, will amount to just about GH?1 billion a year. Over the four year period, this will amount to GH?4 billion.

2. Theoretical and Empirical Literature

2.1 Theoretical Framework

Taxes can affect growth through potentially two channels namely, their impacts on factor accumulation and total factor productivity (Ferede and Dahlby, 2012). First, taxes can raise the cost of capital and reduce incentives to invest, which ultimately affect economic growth adversely.

Furthermore, by providing preferential incentives to some sectors, taxes can distort capital allocation and reduce the productivity of overall investment. Secondly, taxes can affect growth through their influences on total factor productivity. Taxes distort factor prices and induce efficiency loss in resource allocation (Feldstein, 2006), eventually lowering total factor productivity.

Ferede and Dahlby (2012) also indicated that taxes can affect total factor productivity through their potential effects on entrepreneurship. Entrepreneurial activities generate new ideas that can raise total factor productivity, noting that adverse effect of taxes on entrepreneurship reduces the creation of new ideas and lowers total factor productivity.

Tax cuts may be potentially financed in two ways: spending cuts and deficit financing. While spending cuts is the most desirable the current budget regime in Ghana—very rigid due to so many statutory funds—makes spending cuts very unlikely. The resource envelope is usually exhausted after the payment to statutory funds and interest on public debts even before consideration for compensation of employees.

This makes goods and services and capital expenditures (capex) very vulnerable—main options to be cut. However, recent trends show that the budget for goods and services is already very thin and could barely support MDAs’ service delivery. The MDAs complain not only about the size but also the delay in releasing their goods and services budget to them.

This suggests that goods and services budget might not be a good option for consideration as an expenditure reduction policy since it is already low. Since the [NPP] party in 2017 may not have the political courage to cut employment, will capital expenditure (capex) become the victim of expenditure cut? Cutting back on capex would imply two things: (1) abandoning pipeline projects, and (2) failing to fulfill [some] campaign promises. Interestingly, most of the NPP’s own [heavy] campaign promises fall into this expenditure category. And given the commitment to continue with pipeline projects, it appears this expenditure item may be difficult to cut as well.

So will the proposed tax cut be financed through budget deficit financing? Fiscal deficit may be financed through various sources: (1) domestic and external borrowing, (2) monetization, and (3) sale of national assets, among others. Under the ongoing Extended Credit Facility (ECF) Programme with the International Monetary Fund (IMF), central bank financing is zero at least until 2017 [and with commitment to keep it at zero thereafter]. Even if the government defies this conditionality and proceed to borrow from the central bank, this will have far reaching consequences for the economy—at hindsight the currency will collapse. Sale of national assets is always not politically desirable as the government would have to contend with nationalist groups and labour unions. It appears the most preferred option will be borrowing from both internal and foreign sources. Already, there are concerns over Ghana’s public debt ratio, which is considered relatively high at 65.9 percent as at July 2016. Increasing the debt stock could trigger macroeconomic instability through high interest rates, high inflation and exchange rate depreciation. Not only are the political opponents watching, the development partners are also watching, so are the rating agencies and investors.

It appears the NPP still has some hope. The supply-side economists posit that tax cuts could be self-financing due to the large incentive effects they are likely to generate. If the last argument is anything to go by then the NPP [government] does not need to do anything more as those tax cuts will finance themselves through the large incentives they generate in the economy. But some economists disagree with this proposition. They argue that although tax cuts could generate some incentives, they are not large enough to pay for themselves. The extreme view from the Ricardian School is that tax cuts would raise interest rates and lower confidence and thereby reduce output in both the short run and the long run.

The views on the impact of the tax cut on the economy are diverse and divided. The question of how the proposed tax cuts will be financed, therefore, becomes an empirical question.

Empirical Review

Policy makers and researchers have long been interested in how potential changes to the tax system affect the size of the overall economy. However, understanding the impact of tax changes on the size of the economy is an empirical question. Majority of the literature has focused on the impact of personal income tax. Romer and Romer (2014) observe that “tax changes have very large effects: an exogenous tax increase of 1 percent of GDP lowers real GDP by roughly 2 to 3 percent. Dackehag& Hansson (2012) analyzed how statutory tax rates on corporate and personal income affect economic growth in a panel of 25 OECD countries. They found that taxation of corporate and personal income negatively influences economic growth—the correlation between corporate income taxation and economic growth is even more robust. Veronica and Lenka (2012) confirmed a negative relationship between corporate tax burden and long-term economic growth in EU member states for the period 1998-2010. Adudu and Simon (2015) found in Nigeria that efficient tax reforms are necessary conditions for enhanced sustainable economic growth. In a related study, Wilfred (2014) finds that taxation is negatively related to investment and the output of goods and services (GDP) and positively related to government expenditure in Nigeria.

The mean corporate tax rate in Ghana over the period 1990 to 2015 is roughly 30%, while government expenditure to GDP was 20.4% which compares favourably to Ghana’s peers in the middle-income category.

Concluding Remarks

This paper examined the effects of taxation policy on economic growth in Ghana. In particular, the paper examined the impact of corporate income tax cuts on economic growth. A set of tax variables and control factors that can potentially influence real GDP growth is considered in the econometric analysis. Our main findings can be summarized as follows: We find evidence of an elastic relationship between tax variables and real GDP growth rate in both the short run and long run.

In particular, we find that a 1 percent reduction in corporate tax will cause real GDP growth rate to increase by 3.17 and 2.09 percent in the long-run and short-run respectively. The Generalized Least Square estimate showed that tax revenue is growth inelastic. We also found a bi-directional causality between tax revenue and growth for Ghana, though the causality from growth to revenue is mild.

We also found a positive and robust relationship between government expenditure and real GDP growth rate in the short-run. FDI inflows have a positive effect on real GDP growth both in the short-run and long-run.

Estimates by the tax authorities show that a cut in the corporate income tax rate by 5 percentage points could cost the country roughly GHS1.4 billion in corporate taxes alone and over GHS2.5 billion in proposed tax cuts. However, the measure could also improve overall tax revenue by0.416 percent in the short-run.

Considering the heavy expenditure projects being considered by the NPP government, which could cost up to GHS93 billion to implement, this paper argues that the NPP [government] would have to resort to high deficit financing in order to finance its budget. And given the country’s commitment to zero central bank financing under the IMF programme, the only options is to the resort to commercial borrowing with its attendant consequences for the economy.

Policy Recommendations

The paper then makes some policy recommendations on how to improve tax revenue without necessarily jeopardizing growth. The NPP [party] may not be able to pursue the proposed tax cut and expenditure programmes simultaneously. It may have to choose one of the two policies at a time. The possible options therefore, are as follows: (1) borrow heavily on commercial terms to be able to implement both policies simultaneously; (2) suspend the tax cuts in order to be able to admit expenditure programmes, (3) suspend development projects in order implement the tax cuts.