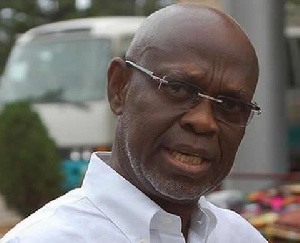

Prof Kwesi Botchwey, Chairman of NDPC)

Prof Kwesi Botchwey, Chairman of NDPC)

...as elections beckon

Dr. Kwesi Botchwey -- the man who led negotiations on behalf of Ghana to structure the three-year IMF stabilisation plan -- has given a resounding assurance that government will stick to the conditions of the bailout even as the country gears up for general elections next year.

B&FT has been told that a major concern of IMF chiefs in Washington is whether the government will be able to keep the tabs on spending in 2016, and achieve targets set by the US$918million balance of payments support programme.

Foreign investors and Ghanaians have also been worried that government will re-enact the cyclical story of overspending and ballooning budget deficit in every election year, with often disastrous ramifications for the economy.

In 2008, the deficit with rebased data stood at 6.6 percent (non-rebased was 11.3 percent), while the target was around 4percent (rebased) of GDP. In 2012 government targetted 6.7 percent of GDP, but ended up with a gaping 12 percent of GDP deficit.

Next year the budget deficit being targetted by government is 5.8 percent, but with current events unfolding -- like public workers’ agitation led by doctors -- many analysts and ratings agencies predict that the government may not be able to meet the target despite the IMF’s presence.

But speaking in an interview with the B&FT, Dr. Botchwey allayed those fears: “I can assure you this time round we can’t do that, and we are not going to do that. Despite elections beckoning next year, government will stick to the plan,” he said.

He said the central bank’s financing of the budget deficit this year has been reduced to only 5 percent of last year’s fiscal revenue; and next year, under the programme, central bank financing of the government deficit will be zero.

The Chairman of the National Development Planning Commission (NDPC) added that government had the option of going for a one- or two-year programme, but opted for a three- year agreement which straddles a political transition and ends in 2017.

“We decided to have a three-year programme; the NDC government could have decided it wanted a one-year programme, but it decided to have a three-year programme; so the rigid rigour of the programme is going to be there through that transition.

“Under the programme, there is a zero-limit on central bank financing for government, and we have already done a massive fiscal adjustment to 3 percent of GDP in 2015; so I don’t see any chance at all of any fiscal profligacy in the run-up to the election, because it can’t be done under the programme.”

Conceding that the current IMF programme is a difficult one, he believes Ghana will pull through and come out better despite not getting the immediate bounce government had hoped for.

“It is a tough programme and we didn’t get the market bounce immediately because a lot of people are sceptical,” he said.

In June, a visiting IMF team gave the government a thumbs-up for its performance in the first review of the programme covering the first four months of the year. According to the team, government met all the performance criteria -- except for the ceiling on central bank financing to the government, which was technically missed.

The positive review bolstered the cedi which had then fallen by 26.2 percent against the dollar, leading to a rally in the currency in July. In the past few weeks, however, the cedi has started depreciating and is on the back-foot again with respect to the greenback.