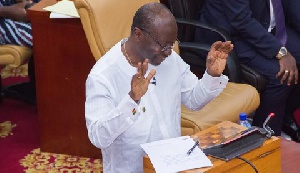

Ken Ofori Atta is Finance Minister

Ken Ofori Atta is Finance Minister

Finance Minister, Ken Ofori-Atta, announced tax reliefs for taxpayers, instead of imposing new on Thursday during the presentation of the 2019 Budget to counter the doomsday predictions of the opposition National Democratic Congress (NDC).

At a pre-budget analysis forum, the Minority in Parliament declared that the government would impose hardship on Ghanaians through additional taxes in the 2019 Budget.

Cassiel Ato Forson, Minority Spokesperson on Finance, who led the discussion, urged Ghanaians to brace themselves up for more economic hardships because the 2019 Budget Statement would most likely focus on massive borrowing and clandestine imposition of more taxes in an attempt to correct the huge fiscal imbalance resulting from the ‘unpardonable’ consumption pattern of government and its populist socio-economic policies.

Mr. Forson, the NDC MP for Ajumako/Enyan/Essiam and former deputy Minister of Finance, said government would definitely add GH¢16 billion to the debt stock in the coming year.

Good News

But presenting the 2019 Budget, Mr. Ofori-Atta said even though government, in the mid-year review, introduced an additional personal income tax band of GH¢10,000 and above per month at a rate of 35 per cent on salaries, it had rescinded its decision.

“We have listened to the feedback from the public and come to the conclusion that some reliefs from this tax measure is justified.

“Accordingly, government proposes to review this band to impact monthly income above GH¢20,000 at a rate of 30 per cent. Mr. Speaker, we will bring the necessary changes to this august House to be legislated.”

Relief for minimum wage earners

The Finance Minister also said in view of the recent wage increases, minimum wage levels had become partly taxable.

“And therefore in keeping with government’s commitment to lighten the tax burden of wage earners at the lower levels of the wage ladder, the minimum wage would attract no income tax.”