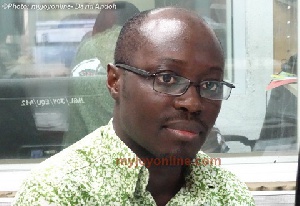

Minority Spokesperson for Finance, Casiel Ato Forson

Minority Spokesperson for Finance, Casiel Ato Forson

The Minority Caucus in Parliament will soon head to court to compel the Ghana Revenue Authority (GRA) to halt the implementation of the 3 percent VAT flat rate scheme.

The scheme was not consistent with existing laws governing Value Added Taxes and as such, its implementation was illegal and should be halted, the Minority has stated.

The Minority Spokesperson for Finance, Casiel Ato Forson in an address with the media said the Scheme violates the VAT ACT 870 and could not be implemented. “Any policy that seeks to impose a tax or that seeks to prevent the wholesalers, importers to deduct their import tax is illegal.

Therefore we are urging the GRA and the Ministry of Fiance to stop perpetuating the illegality. It’s illegal and has no place in the law.

It is not in sync with the spirit of Act 870, it’s Value Added Tax and you cannot in any way implement a tax that is not in sync with the reason why the VAT Act 870 was implemented.”

“We wish to serve notice to GRA to immediately halt this illegality. Failure to do so will mean that we’ll go to court to compel them to stop this illegality.”

“What they [GRA] are only seeking to do is impose a VAT through the backdoor. They are tricking Ghanaians that they are going to reduce taxes but apparently they are imposing taxes because they are preventing the importer from detaching input tax from the output tax. In the VAT Act 870, who constitutes an importer is straightforward, the law is clear on that,” he added.

“All of a sudden we have seen that the Ministry of Finance and GRA have decided to define a wholesaler to include an importer. There’s nowhere in this law that defines wholesalers to include importers.

The importer is a standalone and import VAT is deducted as if it’s an import levy and it should be respected as such according to the law.”