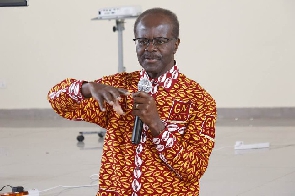

President of Groupe Nduom, Kwesi Nduom

President of Groupe Nduom, Kwesi Nduom

De-Geons Investment limited, one of the company’s which featured in the Group Nduom list of debtors on Thursday has warned the Papa Kwesi Nduom-led organisation to immediately retract the claim that they owe them or be sued.

According to the firm, the debt they took from the GN bank was paid as far back as December 2016.

“We write letter on behalf of our client, DE-GEONSINVESTMENT LIMITED and under the directives of the Managing Director of the same in respect of your publications of the debtors of the erstwhile First National Savings and Loans now GN Bank Limited.

“By virtue of the said publication you indicated vide item 73 that our client is indebted to your GN Bank Limited of an amount of one Million, Seventy-Four Thousand Seven Hundred & Thirty Three Thousand Ghana Cedis thirty-Two Pesewas (GHC 1,074,733.32).

“Premised on the above our client informs us to put it to you as follows: Our client acknowledges that it was once a customer of the Bank on or before the 19th day of December, 2016 and has hitherto ceased to be a customer of the Bank. That our client is not indebted to the bank and the said publication is false, malicious and calculated to damage its reputation,” lawyers for the firm said in a statement.

A clearance letter sighted by Starr News, shows the company was given a full bill of health by the GN bank after they paid off the debt.

Starr News has also intercepted the final payment notice the company sent to GN bank.

As part of the processes initiated by the President and Chairman of Groupe Nduom (GN), Dr. Papa Kwesi Nduom through the Gold Coast Fund Management (GCFM) in court to recover investment funds and pay aggrieved customers of their locked-up investments, a list of companies and individuals indebted to GCFM has been released. The list includes construction companies and top firms in different sectors of the economy.

Senior High Schools such as O’Reilly have been also captured in the list with a debt of over GHc3.5 million.

In all over 4200 companies, secondary schools, individuals, pastors, and other professionals are indebted to Goldcoast Fund Management (GCFM) to the tune of over GHc423 million.