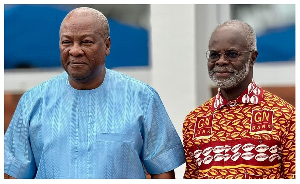

Former President John Dramani Mahama and Dr Papa Kwasi Nduom

Former President John Dramani Mahama and Dr Papa Kwasi Nduom

Global President of Groupe Nduom, Dr. Papa Kwesi Nduom, has described as shocking how the operating license of his subsidiary bank, GN Bank, was revoked by the Bank of Ghana in 2019.

During a courtesy call on former President John Dramani Mahama who is the flagbearer of the opposition National Democratic Congress, Dr. Nduom said he had engaged extensively with the management of the central bank and fashioned out a process to revitalize the bank. Thus, he found it shocking when the Bank of Ghana turned around and collapsed his bank.

“The governor who is there sat with me and said, 'Why don’t you accept to be reclassified from a universal bank to a savings and loans company, knowing that for savings and loans, the minimum requirement is only 15 million?'” he told the former president.

According to him, he heeded the governor’s advice and subsequently satisfied some six conditions set out by the Bank of Ghana, including having a capital of over GH¢200 million, well over the minimum requirement.

“Remember, for savings and loans you require GH¢15 million. So imagine my shock when I am sitting in Chicago doing some work and in August I am told that they have taken our license,” he stated.

He thus appealed to former President Mahama to reinstate GN Bank’s license if he wins the December 7, 2024, elections.

“We believe that if this administration doesn’t give us our license before they leave and start paying the money before they leave, the next one will understand the situation and give the license back. So, we are continuing with hope, preparing and working on our plans with the hope that, at some point, we will get the license back and bring the jobs back. Because it is the jobs that we are also looking for,” Nduom stated.

He emphasized that the collapse of a 300-branch financial entity is detrimental to the country's economic interests, regardless of ownership.

“We feel that collapsing a 300-branch financial entity is inimical to the economic interest of the country. So, whether it even belongs to us or belongs to someone else, it is something that needs to be there,” he stated.

Imagine my shock when I'm sitting in Chicago doing some work and I'm told they have taken our license - Dr. Paa Kwesi Nduom pic.twitter.com/ALIatr7UWU

— GTV Ghana (@GTV_Ghana) July 19, 2024